Advocacy

in Action

August 2016

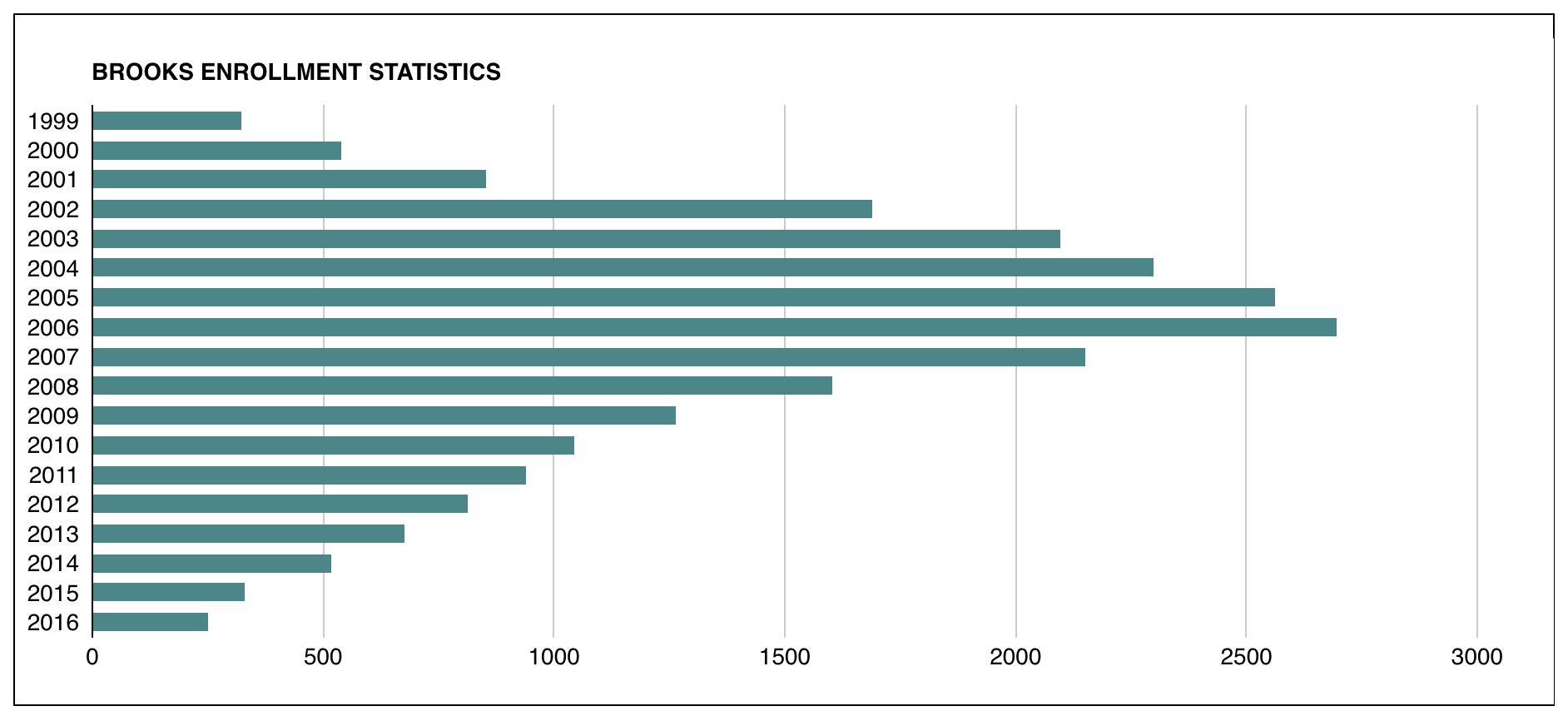

CEC announces Brooks Institute shut down. Alumni turn to Facebook to commiserate and exchange student loan war stories.

Ashley Pizzuti, Evelyn Cervantes, and a few others started Facebook groups for Brookies to vent about their student loans, exchange research and strategies to help deal with their debt. Eventually they would combine groups in what is now Brooks Institute Borrowers Advocacy Group. Currently, the group has just under 2000 members who took out student loans to attend Brooks.

October 2016

Brookies file for Borrower Defense to Repayment.

Brooks Borrowers start sharing their personal Brooks/CEC research and strategies in filing for Borrower Defense to Repayment. A department of education program that provides loan forgiveness for those who attended scam schools. Several new borrowers were being vetted and added to the facebook group daily, encouraging each other to apply.

April 10, 2017

Ashley Hardin shares her story with the New York Times

Regarding The Consumer Financial Protection Bureau and state attorneys general in Illinois and Washington filed lawsuits against Navient, the nation’s largest servicer of student loans, accusing it of extensive mistakes and violations. The state lawsuits also contain accusations of predatory lending.

October 10, 2017

January 11, 2018

Ashley Hardin travels to Olympia, WA with Christina Henry to testify in support of SB 6029.

View Bill Report here.

March 22, 2018

Rep. Tina Orwall’s 3SHB 1169 SOAR Act is signed, aligning Washington wage garnishment maximums with the national average, protecting borrowers’ professional licenses, and giving the people the tools they need to pay back their student loans.

View Bill Report here.

May 30, 2018

Ashley Pizzuti launches loan data campaign.

August 27, 2018

Ashley Hardin is interviewed to share her story in the NBC report on Seth Frotman, the Nation’s Student Loan Watchdog’s resignation.

View report NBC Nightly News.

October 22, 2018

Hardin is interviewed to share her perspective as someone who’s dream to start a business was crushed by overwhelming student debt.

January 16, 2019

Ashley Pizzuti meets with HERA and Project on Predatory Lending to Share Data

Pizzuti meets with California Housing and Economic Rights Advocates (HERA) and Harvard Law School’s Project on Predatory Lending to share collected Brooks Borrowers student loan data information.

May 17, 2019

State Assembly Hearing on Student Debt Crisis @ The University of CA. Irvine

Rachel Greenbaum provides testimony on her experience with predatory student loans at the California State Assembly Hearing on Student Debt Crisis.

April 19, 2019

Theresa Sweet meets with California lawmakers regarding new for-profit regulations.

Though HERA and TICAS. Theresa Sweet meets with California State lawmakers who are considering seven different bills aimed at regulating trade schools and for-profit colleges. Lawmakers said the bills are designed to take the place of federal regulations the Trump administration has proposed to scrap.

June 25, 2019

The Sweet v. DeVos Case is Filed

Brooks Borrower Theresa Sweet and six other federal student loan borrowers file the Sweet v. Devos class action lawsuit, challenging the Department of Education’s indefinite indecision on borrower defense cases.

View filed settlement motion here.

June 25, 2019

Class Action complaint is submitted by the Sweet Vs. Devos plaintiffs

The complaint points out the Department of Education’s intentional adoption of a policy of inaction and obfuscation. The plaintiff’s request was simple: compel the DoE to start granting or denying their borrower defenses and vacating the Department’s policy of withholding resolution.

View the complaint here.

October 25, 2019

Judge grants class certification to 200,000 student borrowers in Sweet v. DeVos Class Action

This victory for borrowers ensured that the voices of former for-profit college students, who have been cheated by their school and ignored by their government for years, will be heard.

December 7, 2019

Rachel Greenbaum speaks at the ‘Free my Future’ Summit for HERA

Rachel Greenbaum speaks on the “California Confronting the Student Debt Crisis – the Student Borrower Bill of Rights” panel

April 10, 2020

Sweet v. DeVos reaches settlement over stalled student debt relief claims

If approved, the Trump administration agrees to process nearly 170,000 debt cancellation claims within 18 months, giving the Education Department a year and a half to clear out the backlog of claims and cancelling any interest that accrued on the loans while applications were pending.

April 23, 2020

Theresa Sweet, lead plaintiff in the Sweet v. DeVos case, celebrates the class action lawsuits success, saying it “feels like a huge victory.” But even if her federal loans are forgiven tomorrow, she says, “I’m still starting from scratch.”

June 1, 2020

July 7, 2020

The Debt Collective was formed as an offshoot from Occupy Wall Street and the Occupy movement, to assist in emanating, crushing and predatory debt. They are responsible for the 2012 Rolling Jubilee which purchased loans on secondary market for a fraction of their original worth and forgave them. They are responsible for helping “Corinthian 15” in organizing and ultimately bringing down the predatory enterprise. Currently, they have positioned themselves as a debtors union and are pushing for a nationwide debt strike. Ashley plays a small, but important, volunteer role representing for-profit borrowers.

September 17, 2020

Declaration of Eileen M. Connor Submitted

Eileen M. Connor, attorney for the Project on Predatory Student Lending at the Legal Services Center of Harvard Law School, files a declaration in reaction to the blanket denials, requesting a court hearing.

View the declaration here.

October 1, 2020

Student Borrowers Speak Out In Unprecedented 500-Person Court Hearing On Borrower Defense

Borrowers To Judge: “Department Of Education Can’t Be Trusted To Process Borrower Defense Claims Fairly”

In a historic Sweet v. DeVos Fairness Hearing with well over 500 tuning in over Zoom. U.S. District Judge William Alsup listened to 14 class members gave testimony on how the delay and denial of their BDTR experience has impacted their lives. Brooks Borrowers Rachel Greenbaum, Rebekah Sanchez Norton, and Victoria Linssen among them. Many more class members told their stories through the Zoom chat feature which was later added as official court testimony.

October 19, 2020

Proposed Class Settlement is Denied, Discovery is resumed

Following preliminary approval of the proposed class settlement meant to restart DOE review of student-loan borrower-defense applications under the Higher Education and Administrative Procedure Acts, the Secretary of Education’s (Devos) new perfunctory denial notices undermine the proposed settlement, contradict her original justification for delay, raise substantial questions under the APA, and may impose irreparable harm upon the class of student-loan borrowers.

View the order here.

October 21, 2020

“Disturbingly Kafkaesque” Judge Alsup regarding the blanket denials.

U.S. District Judge William Alsup responds with an offical statement regarding the Fairness Hearing, “It’s no wonder borrowers are confused. The Secretary’s perfunctory denial notice does not explain the evidence reviewed or the law applied. It provides no analysis. And, the borrower’s path forward rings disturbingly Kafkaesque,” he wrote. “Without any meaningful analysis of the evidence under the law, how might a borrower articulate such bases for reconsideration? It is, after all, impossible to argue with an unreasoned decision.”

November 24, 2020

In Victory For Borrowers, DeVos Agrees To Stop Issuing Mass Denials Of Loan Forgiveness Applications

Student loan borrowers score a victory in court against Education Secretary Betsy DeVos, as litigation continues over mass denials of student loan forgiveness applications.

December 19, 2020

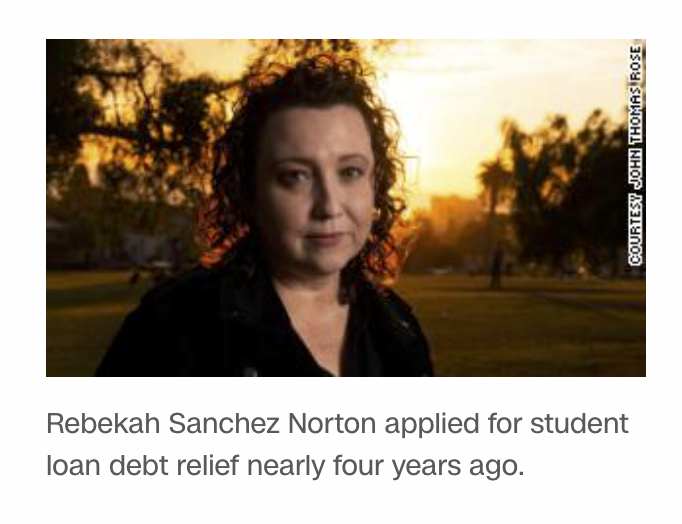

“I feel like I’ve lost my faith in the government”

Rebekah Sanchez Norton speaks to CNN about trying to remain hopeful that the new incoming administration will undo the Trump administration’s stalling. CNN

January 7, 2021

Betsy DeVos resigns as Secretary of Education

March 1, 2021

Confirmation of Miguel Cardona for Secretary of Education

March 18, 2021

Sweet v. DeVos plaintiffs find more evidence during discovery

“During the discovery period, Plaintiffs uncovered additional evidence demonstrating the illegality of the Department’s perfunctory denial notices and the process that the Department used to arrive at those denials. Accordingly, Plaintiffs now seek leave to file a Supplemental Complaint to add claims that the Department’s use of boilerplate denial letters violated section 555(e) of the APA, and that the Department’s process of adjudicating borrower defense applications violated section 706(2)(A) of the APA and the Due Process Clause of the U.S. Constitution.”

See full document here.

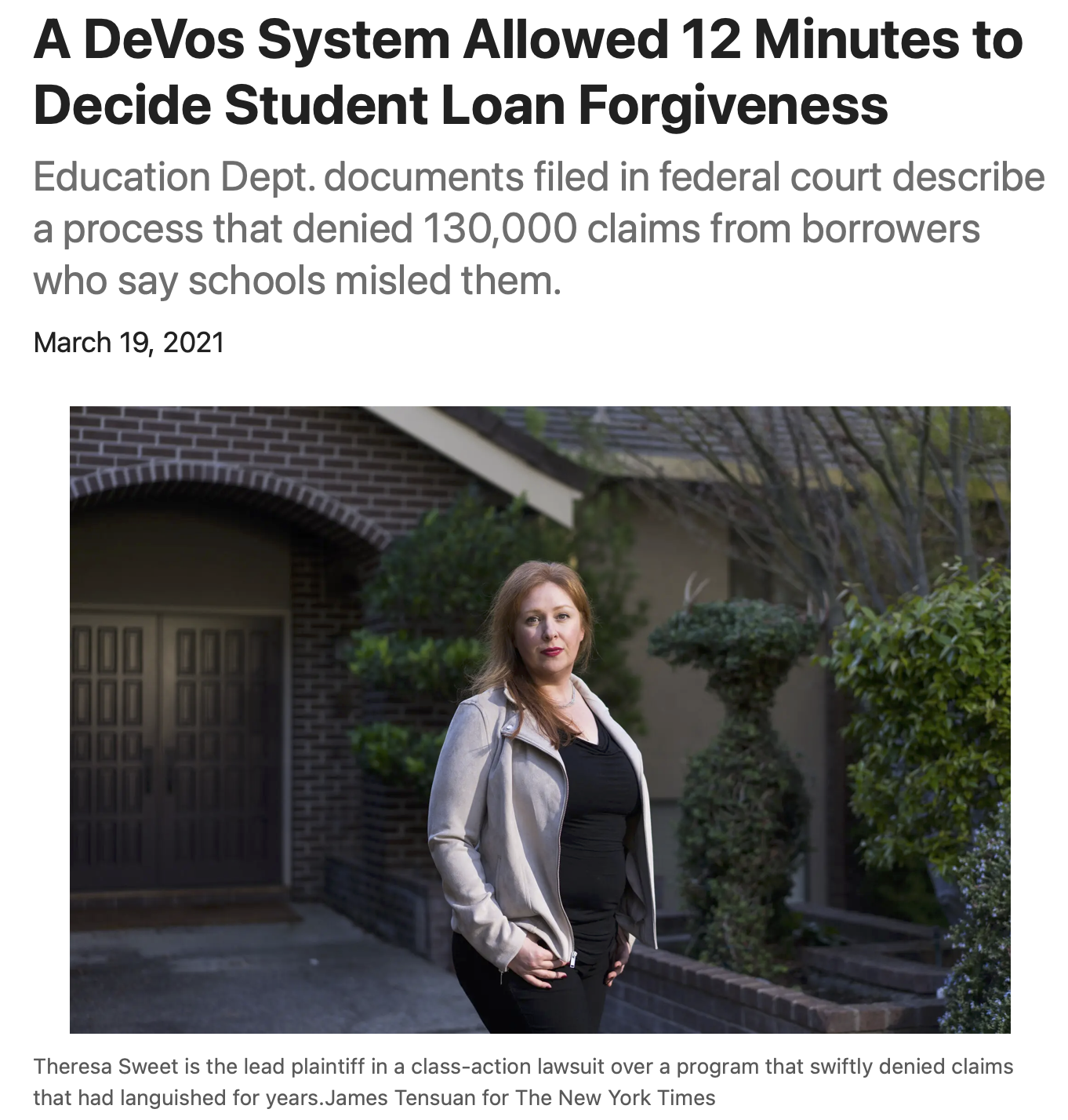

March 19, 2021

Theresa Sweet speaks with New York Times on Sweet v. DeVos and how these loans, the failure of due process, and how this debt has impacted her life.

March 26, 2021

Defrauded for-profit students demand relief after documents expose DeVos rejection system

Ashley Pizzuti Speaks with Yahoo Finance about her five year wait with Borrower Defense. Discusses the impact on her family as their debt reaches half a million dollars. Ashley is married to another Brooks borrower.

June 1, 2021

The DOE starts approving BDTR claims for select bad actor schools

Brooks Borrowers have yet to find relief.

June 10, 2021

Ashley Pizzuti mets with DOE and FSA.

Ashley Pizzuti meets with Acting Under Secretary Julie Morgan and FSA COO Rich Cordray to discuss the impact of attending a for-profit school and push for loan forgiveness.

August 10, 2021

DOE Announces Committee for New Student Loan Rules

The DOE announces the intent to establish the Negotiated Rules for Affordability and Student Loans Committee or NegReg. The committee is meeting to address issues that include: borrower defense to repayment; closed school, false certification, and total and permanent disability Federal student loan discharges; income-driven repayment; Public Service Loan Forgiveness; pre-dispute arbitration and required class action waivers; interest capitalization; and Pell Grants for people who are enrolled in prison education programs.

Negotiators are nominated by the public, and selected by the DOE. This may include, but is not limited to, students, legal assistance organizations that represent students, institutions of higher education, state student grant agencies, guaranty agencies, lenders, secondary markets, loan servicers, guaranty agency servicers, collection agencies, state agencies, and accrediting agencies.

Typically, the Department convenes committees of 12 to 15 negotiators, as well as an alternate for each negotiator to ease attendance concerns for negotiations consisting of multiple full day sessions. Each committee includes at least one DOE representative.

August 31, 2021

Theresa Sweet garnered over 1200 signatures to be nominated for NegReg

Theresa Sweet was nominated as a negotiator for the Affordability and Student Loans Committee by Project on Predatory Lending with endorsement of the Education Trust, The institute for College Access and Success, Student Borrower Protection Center and New America Higher Education Program in addition to the over 1200 signatures from for-profit borrowers.

October 4, 2021

NegReg starts,

For-Profit Borrowers Left out.

The DOE decided not to allow Theresa Sweet to participate as a committee member. Several NegReg committee members argue to override the decision as she is the perfect candidate to represent for-profit borrowers. There are currently no for-profit borrowers, however, there is a chosen member to represent the for-profit industry. The DOE cites a conflict of interest due to Sweet v. DeVos.

Start Video at 1:31:19

October 4, 2021

Evenlyn Cervantes & Ashley Pizzuti nominated to NegReg

Despite the Sweet v. DeVos conflict of interest, several committee members offered alternative options to include for-profit borrowers in the negotiation of the student borrower rule making. This included Ashley Pizzuti and Evenlyn Cervantes as alternates.

NegReg is run by consensus. It took only one no vote from the for-profit industry to disallow them to be considered.

There were no for-profit borrowers on the committee.

October 5, 2021

Theresa Sweet goes “Scorched Earth” on NegReg in public comment.

“I would like to address just a few of the committee members that have conflicts of interest so egregious that it’s almost laughable you can claim to be negotiating in good faith to protect students.”

“There is a fox guarding the hen house”

October 5, 2021

Evenlyn Cervantes called out the Department for their lack of for-profit borrower representation.

“Your votes not to include students impacted by borrower defense are incredibly reflective of your interests. I am looking at those of you previously involved with for-profit education organizations. You should not have a seat at this table. For-profit colleges have disproportionately affected communities of color. Looking at you now, I know that this committee is not reflective of that either. How can you say that you are working to make effective changes when the basic properties of this committee do not reflect those of the people you are serving?”

October 7, 2021

Ashley Pizzuti calls NegReg out about disappointment in the public speaking segment.

The Negotiated Rules Committee Zoom meeting always ends with 30 minutes for public comment.

“It’s pretty telling when the student loan profitiers still control the narrative. I’m utterly disappointed our voice is being shut out.”

October 10, 2021

The Real Heroes Of Negreg

Project on Predatory Lending makes a statement about for-profit borrowers being shut out of NegReg.

December 7, 2021

Affordability and Student Loans Committee Meeting Session public comment

Kristina Boudreau, a member of the class action Sweet v. Devos, speaks on her experience being defrauded by predatory for-profit school, Brooks Institute (CEC) in the public comment portion of the December NegReg Committee meeting.

Watch the hearing YouTube.

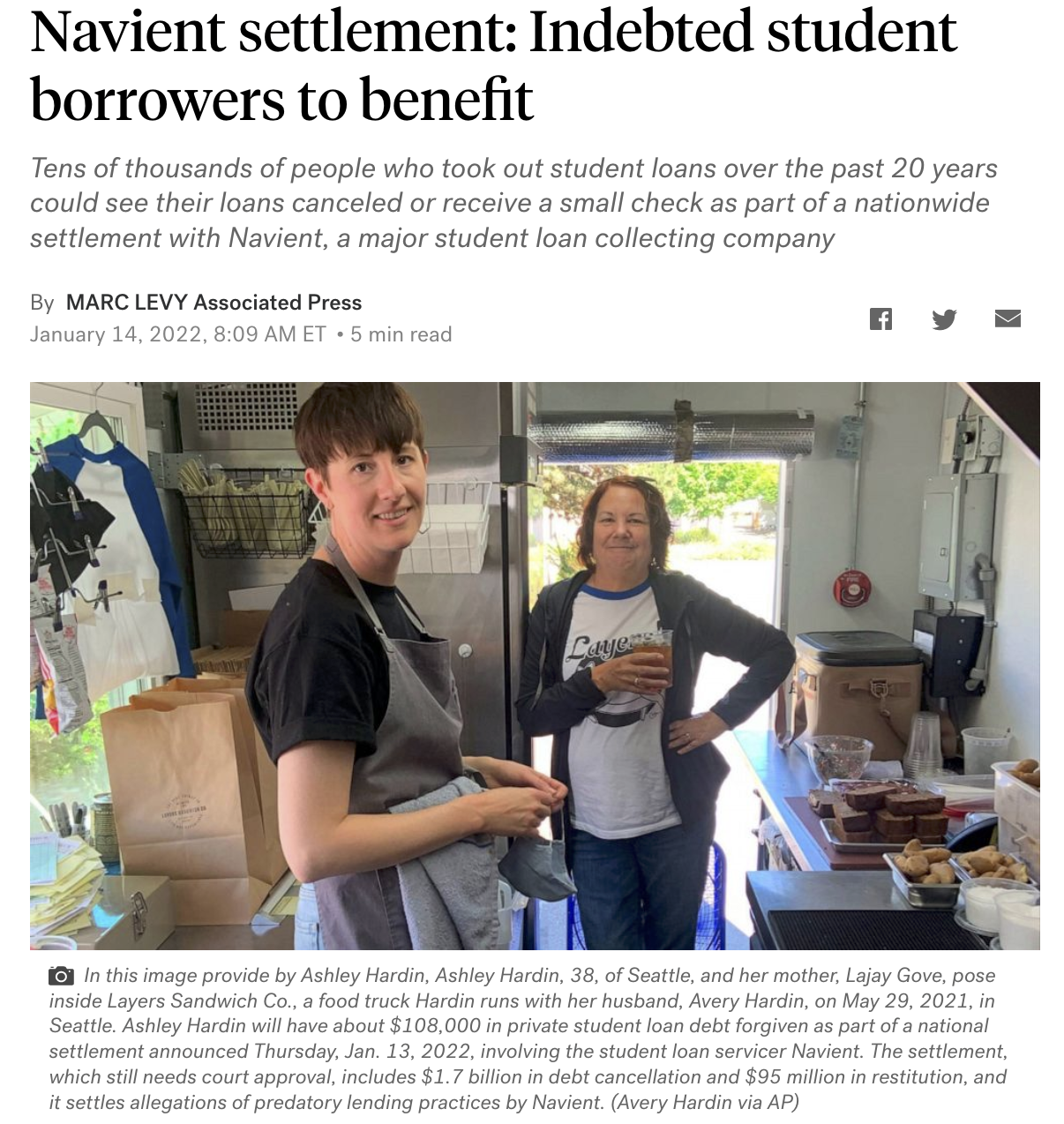

January 13, 2022

Navient agrees to cancel 66,000 student borrowers’ loans to settle claims of predatory lending – Brooks/CEC named as bad actors

Navient settles a 2017 lawsuit brought forth by Consumer Financial Protection Bureau (CFPB) and six state attorneys general asserting a variety of allegations.

Their settlement did not admit fault but would provide private loan forgiveness to those who attended a ‘Bad Actor’ school and fit a small window of criteria. CEC and specifically Brooks Institute were named as Bad Actors.

January 14th, 2022

Brook Borrowers Anticipate Private Loan Forgiveness.

Ashley Hardin talks to abcnews about anticipating about $108,000 in private student loan debt forgiven as part of the Navient settlement.

January 24th, 2022

Who Gets to Be an Expert on Student Loans?

Ashley Pizzuti speaks with The New Republic about being excluded from federal rulemaking committee NegReg and shares her 20 year old Brooks history.

February 17, 2022

The $1.7 Billion Student Loan Deal That Was Too Good to Be True

Victoria Linssen spoke with NYT on being left out of the Navient Settlement yet Brooks being named a ‘Bad Actor’ and paying every month on time. Sometimes forgoing groceries.

Navient’s Settlement only covers a select number of borrowers who have been in default for at least 7 months but have yet to reach their state’s statute of limitations. Borrowers who have been making payments were left out of the settlement all together.

April 19, 2022

“Student borrowers are owed an explanation for the unlawful delays in processing their borrower defense claims.”

Project on Predatory Lending makes a statement about the progress of Sweet v. DeVos. The DOE has failed to reach a settlement with the plaintiffs regarding their Borrower Defense applications. The Trial is set for July 2022 if no settlement has been reached.

May 1, 2022

A few Brooks Borrowers were notified of fogivness.

A handful of Brooks Borrowers have reported receiving private loan forgiveness letters from the Navient Settlement. Some have reported mistakes, like only forgiving one of several loans even if they all fit the criteria.

Others continue to be outraged by being left out.