1949

In the beginning.

Brooks Institute of Photography was founded by World War II veteran Ernest Brooks Sr. After returning from service he rented a small office over a bakery on a busy street in the small seaside town of Santa Barbara, California.

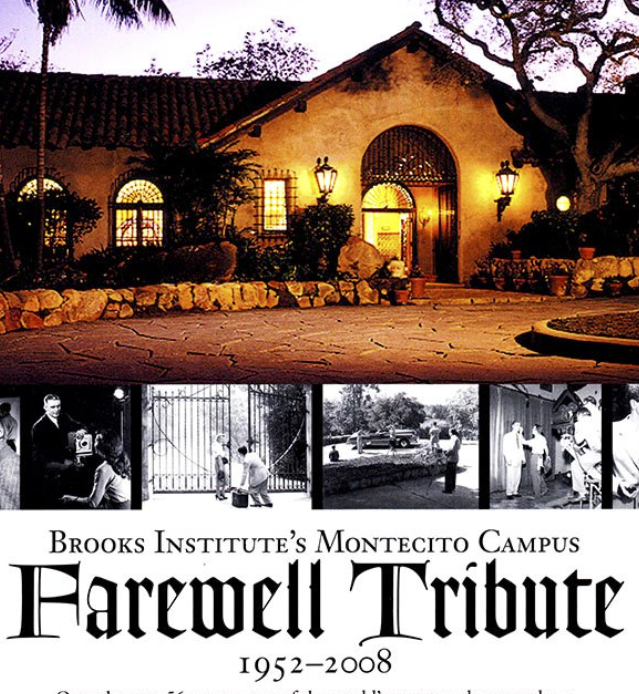

With only 30 students, mostly veterans returning home and using the GI Bill, they quickly outgrew the space and purchased the former David Gray estate ‘Graholm’. A beautiful property in the hills of Montecito and converted it into a campus that housed both his family and the school.

Over the years Brooks became a world renowned photography school and a pionare in underwater photography among others. As both their demand and course offerings they expanded the campus to two other Santa Barbara locations.

His son, Ernie Brooks Jr, following in his father’s footsteps he would take on the roll of president when his father finlay retired to the Chairman of the Board position in 1970 in which he stayed until 1990 at the time of his death.

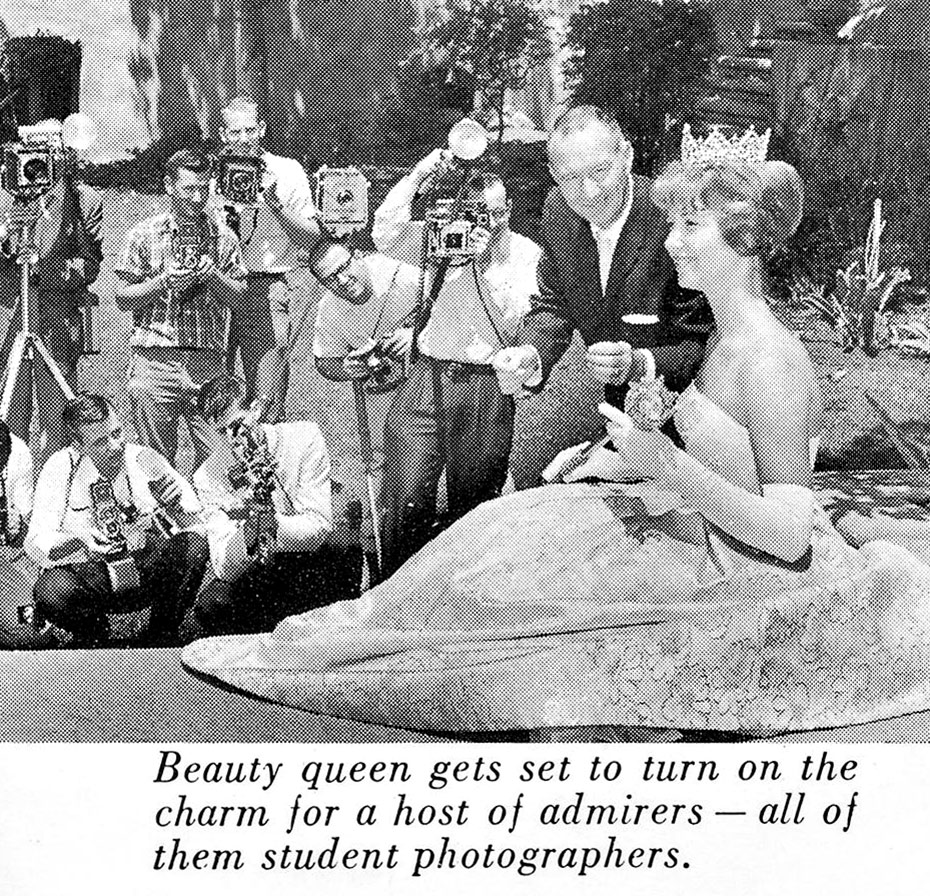

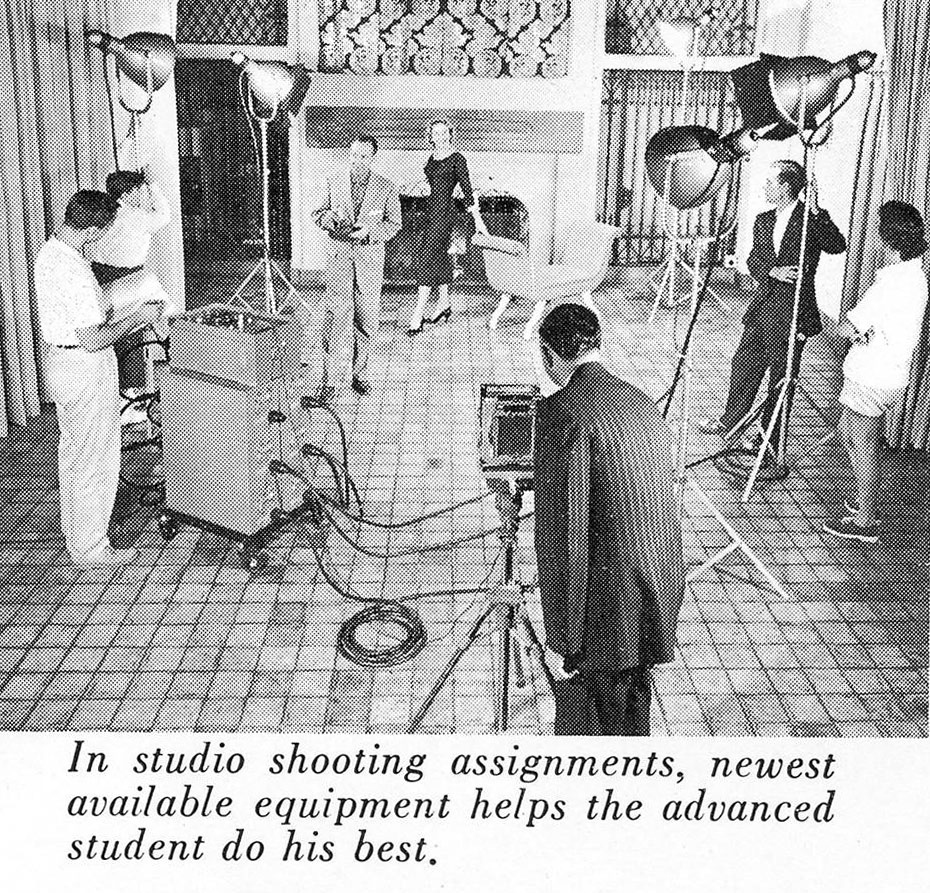

– Early Brooks Marketing –

1985

In 1985 Brooks Institute lost its standing with the Accrediting Commission for Schools, Western Association of Schools and Colleges [ASC WASC] , because of financial reporting irregularities discovered during its accreditation review cycle. The school was then switched to Accrediting Council for Independent Colleges and Schools or [ACICS] which was a national accreditation body that dealt with mostly for-profit education. ACICS would later come under investigation as their accreditation standards were found to be in violation of federal guidelines.

1994

Career education corp. / NASDAQ : CECO

Career Education Corporation (CEC) was founded in 1994, by John M. Larson (Jack) with a reported mission to acquire possession of established private colleges and streamline their profitability. The reported revenue for their first fiscal year was $7.5 million.

The company went public in 1997 and increased profits to more than $45 million within 3 years.

By the end of 1998, CEC had acquired 21 schools, who had a combined population of more than 16,000 students. The combined revenue from these newly acquired institutions nearly tripled in one year, reaching $144.2 million, with a net income of $4.3 million

Shortly thereafter, CEC formed a Professional Education Loan Program in partnership with the Student Loan Marketing Association, aka Sallie Mae.

1999

CEC buys brooks

In 1999, the Glass-Steagall Act was repealed via the Clinton Administration, paving the way for banks to be deregulated which resulted in a loss of government oversight.

The same year, CEC purchased Brooks Institute of Photography for $6.6 million.

John Calman replaced Ernie Brooks Jr. as president and started expanding its marketing and recruitment efforts. Many of the well respected faculty members were laid off and replaced with recent college graduates that had little to no teaching experience.

2001 Brooks TV Commercial

2001

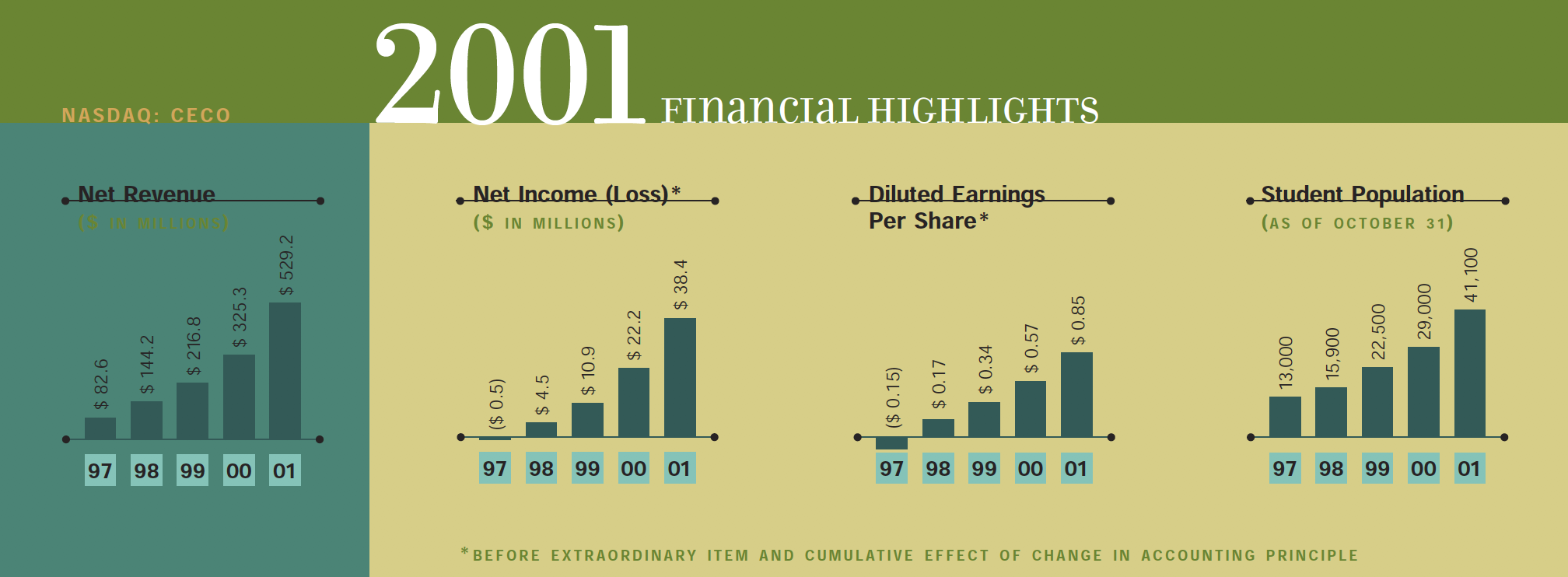

Career Education Corporation Summary Annual Report

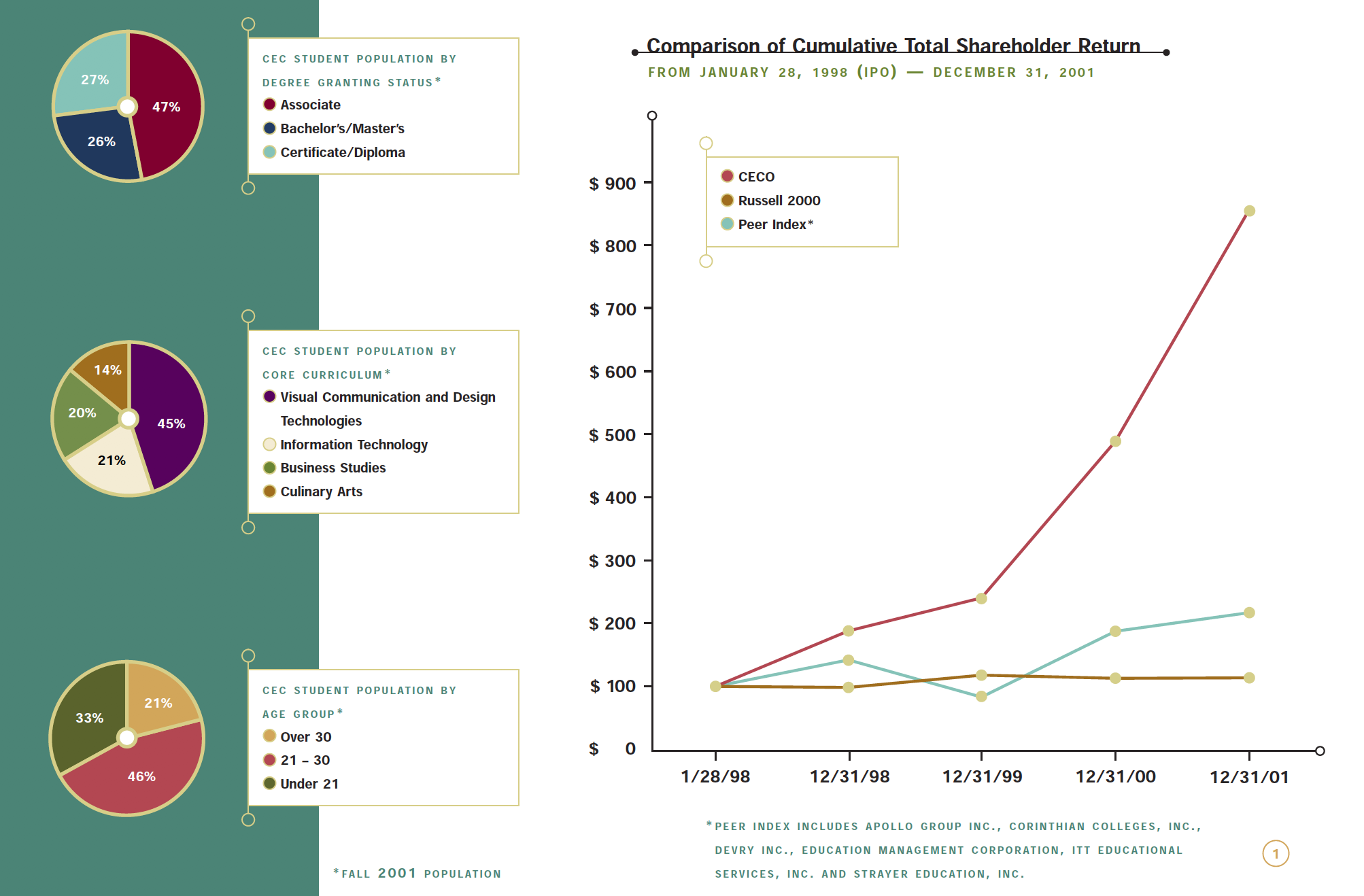

According to CECs 2001 shareholders annual report, a shift in business modalities was vocalized which stated that moving forward, “During 2002, we expect to generate more revenue from brick-and mortar campuses compared to any group in the private, for-profit postsecondary education industry.” There were approximately 41,100 students spread out between 42 different CEC owned schools, with an annual net revenue of $529.2 Million and a net income of $38.4 million. This put CEC as the second largest for-profit postsecondary education company in the United States, just behind the Apollo Group.

Share values skyrocketed. Keeping shareholders happy meant increasing enrollment, maintaining student population levels, while lowering operational costs and standards that kept students graduating. This translated into a decline in the quality of education promised and provided, and a decrease in facilities and equipment offered within those institutions; all the while CEC increased its shareholder stock value on the NASDAQ.

CEC created an aggressive recruiting program within all their schools. Installing policies with the intention of increasing the student body population throughout their portfolio of schools.

According to testimony found in court documents, examples of these new policies included but are not limited to; setting extreme quotas for admissions recruiters requiring them to make 125 calls a day, and a minimum of 10 enrollments per month.

Using car salesmen and telemarketers’ sales tactics, recruiters were pressured to enroll a new student in under 14 days after their initial inquiry. This behavior was not limited to just Brooks Institute, but has been a repeated accusation(s) from the many CEC owned education institutions.

Numerous Brooks Borrowers and students have reported being enticed to enroll based on the promise of ongoing and catered assistance that guaranteed job placement after graduation through the schools Career Services department. Recruiters made exaggerated claims that graduates would receive starting incomes that ranged from $60k – $150k annually in their field-of-study upon leaving the program, which would allow them to pay off their loans within a year or two.

HOLDING PLACE

video – old 90s office phone.

telpropt coversation between potental student and admisions rep.

Potental Student: hello I’m calling to learn more about Brooks…….

2002

BROOKS EXPANDS

CEC’s aggressive marketing and recruitment caused their student population to expand exponentially. Brooks signed a 15-year lease on a 73,000-square-foot building in Ventura, California. Thirty miles south of the Santa Barbara campuses.

The Ventura campus was formerly Santa Ventura Studios and housed a 30,000 soundstage, where parts of Erin Brockovich, Titanic and Cast Away movies had been filmed. A huge selling point to prospective students.

“School President John Calman said the new facility dwarfs the school’s former, 7,000-square-foot film studios. He hopes to expand Brooks’ film student population to at least 500.” Los Angeles Times

2003

BROOKS FIRST WHISTLEBLOWER

Former registrar Cam Van Wingerden, of Brooks Institute of Photography, alleged in a complaint filed with California’s Bureau for Private Postsecondary and Vocational Education that, “The school falsified student records to ensure it passed inspections by accreditation auditors, with the aim of maintaining accreditation and increasing enrollment.” Van Wingerden also alleged that the school went as far as to knowingly enroll under-qualified students, giving special consideration to failing students, and by moving staff throughout the seven distinct campus locations to give the appearance of a fully staffed school for the duration of the accreditation audits. Unlike the enrollment process utilized by the previous owners, CEC enrolled students over the phone without requiring a portfolio review.

“Many staff members have been asked by management to commit forgery, fraud, perjury or whatever else is necessary to pass audit inspections,” she [Cam Van Wingerden] wrote in her letter to the accrediting council. “Too many times have staff members placed themselves in legally compromising positions out of fear for their jobs.” – Cam Van Wingerden Santa Barbara News Press | 2003

Many of Van Wingerden’s allegations named BIP’s Provost, David Litschel and Associate Dean, Nathan Flint as facilitators of these fraudulent practices. Several former staff and faculty members came forward in support of Van Wingerden’s claim. Former Financial Aid Director, Cecilia Schneider and Financial Aid Advisor, Elizabeth Shiffrar for the school supported Van Wingerden’s claims. They further added that admissions recruiters would routinely lie to out-of-state prospective students about their eligibility to receive funding through grants and scholarships, who would then arrive at school only to find they were not eligible for these funds, and who were then systematically encouraged by CEC employees to take on private loans that predominantly required cosigners.

As a tactic to meet the newly imposed increased enrollment quota, it was common practice for admissions recruiters to pressure students into immediately signing enrollment agreements, months before their actual start date, by fabricating a false sense of urgency that the student would “lose their spot” or tuition rate. By increasing the schools enrollment records they also increased their eligibility for higher student loan allowances. All three whistleblowers left Brooks for ethical reasons. According to a Santa Barbara News Press article in 2003, a half-dozen former and present staff members and students, who spoke on grounds of anonymity (fearing retaliation, job loss, or damage to their reputations), agreed that the allegations were common practice.

“The First Week, I had three (new) students at my desk crying” after they came to Santa Barbara and learned they were ineligible for aid. some of whom traveled long distances or from other states believing they were eligible for grants or loans only to find out on arrival that they were not. The recruiters had “promised financial aid and basically lied,”Morally, I could not work there. It was all about sales” – Financial Aid Advisor, Elizabeth Shiffrar – Santa Barbara News Press | 2003

Desperate to maintain accreditation and access to Title IV funding, Brooks and CEC denied any misconduct claiming Cam Van Wingerden was a disgruntled ex-employee and assuring students and parents it was an isolated matter. Pressured by increased tuition costs, a group of students staged a tuition strike in the name of transparency. The students claimed, “classes were overcrowded, teachers spread thin, and the promised equipment was unavailable to checkout.” At this time, approximately 2000 students were enrolled at Brooks Institute of Photography, paying an average of $20,000 per year or $3333/session, bringing-in $6.7 million each eight-week session. As a result of the publicity of Van Wingerden’s allegations, it’s estimated that CEC lost over $1 billion in stock value in one afternoon.

“The educational Abilities of our faculty were compromised by the rising class sizes, limited resources like computers, equipment and supplies, and the bullying of our Director of Education 9now Provost) David Litschel. While I can’t prove the request made to Cam Van Wingerden to forge names, several of my colleagues were requested to raise grades so that students could move forward in the program, which was astounding since students were able to pass a class with a CEC mandated D grade anyways. I taught many kids who deserved less.” – Thomas Schabarum Faculty – Letter to Ventura County Star | 2003

2004

Trouble Beyond Brooks

Meanwhile, on the other side of the United States, Twana Rose, a former top official at Gibbs College in New Jersey, filed a lawsuit against CEC in November 2004, claiming she was wrongfully terminated for refusing to falsify student records. Vinod Kapoora, former faculty member at CEC owned American InterContinental University in Los Angeles, also filed a wrongful-termination lawsuit for the same reason. Ms. Rose alleged in her complaint that the school allowed those who had failing grades or did not complete required courses to graduate. That the school doctored student records to make attendance and graduation numbers look better, citing the case of someone who was billed for two semesters of classes and given passing grades despite showing up for just one day of school. George Ogg, a former admissions director at the Pennsylvania Culinary Institute said he was fired for not increasing enrollment fast enough. After tirelessly complaining to the school, Mr. Kapoora went to the CEC board of directors, stating, “In addition to enrolling students who did not meet requirements and admitting imaginary students, the abuses included; creating fictitious courses, falsely advertising that the school provided job placement for all students in their fields of study and forcing teachers to raise students’ grades to improve graduation rates. The school encouraged students to stay in classes and fail rather than drop them. That way, the federal student-aid funds would continue to flow in.” He was fired ten days later. “The federal government paid tuition bills for courses not attended or passed by students”, charge within the shareholder suit. “[Career Education] improperly recognized and reported such payments as revenue.” At least two schools failed to report when students dropped out in order to keep Title IV funding, the shareholder complaint alleged. CEC used ‘back billing’ tactics to keep dropouts enrolled. While the official policy was to drop students who were absent 20 days or more, the lawsuit says that school officials at one campus tried to “coax” dropouts back to school, so their aid money could be collected for the entire session. Additionally, enrollment and loans were given to those with bad or no credit.

In 2004, several students filed suit against CEC, stating they were intentionally misled to believe the school had a 95% job placement rate. One plaintiff, Esther Outten, happened to work in the placement office of CEC’s American InterContinental University Los Angeles campus, where she was also a student. Outten says her supervisor told her that in order “to keep placement numbers up and appealing to prospective students, we have to fudge the numbers every now and then.” CEC considered any job held by a former student as ‘successfully employed’, including part-time jobs not held within the industry of study. The extent of assistance from the school’s Career Services Department consisted of providing graduates with job listing from local want ads, publicly advertised job fairs, and/or temp agencies that were often unrelated to the student’s specific field of study. Many students who dropped out of Brooks in search of better education found other colleges or universities would not accept their transfer credits due to the unrecognized ACICS accreditation, which Brooks had proclaimed to enrolling students were widely accepted. According to students’ testimony, these practices continued until the school closed in 2016.

In June 2004, just after the consolidation of the separate shareholders class-actions, an amendment was added statin, more than a dozen former Career Education Corp employees witnessed the falsification of student records, showing a higher rate of enrollment than was actual- in an attempt to collect federal financial aid for students who neither attended, completed nor passed classes, as well as to count “as active students”, many of whom never showed-up for classes.

2005

60 MINUTES AIRS CEC UNDERCOVER INVESTIGATION

On January 31, 2005, TV docuseries 60 Minutes ran, ‘For-Profit College: Costly Lesson’ , an expose on CEC misleading its students with promises of job placement and unrealistic salaries. They interviewed several students and faculty from Brooks College in Long Beach, CA (a different institution from Brooks Institute of Photography but also owned by CEC). The admissions representatives claimed they were pressured to enroll at least three new students per week regardless of their ability to complete the coursework, or they would be fired. If they could not ‘close’ them [students enrollment], much like car salesmen, their boss would come in to close the ‘deal’ for them.

“We’re telling you that you’re gonna have a 95 percent chance that you are gonna have a job paying $35,000 to $40,000 a year by the time you are done in 18 months,” says admissions rep. Eric Shannon. “We later found out it’s not true at all. In an evaluation conducted by Western Association of Schools and Colleges they found that, only about 38 percent of Brooks Institute students ever finish the program,” and the average starting salary for all graduates is “less than $11 dollars per hour.” Tami Hanson, who was once the national manager in charge of student placement for all of Career Education Corporation’s campuses in the United States, and was one of 50 current and former employees that 60 Minutes interviewed stated they all had variations of the same story; “All about the numbers, all about the numbers,” said Hanson. “Getting students enrolled, getting students in the seats. Keeping students in the seats, getting them passed enough to graduate, and then trying to get them any job we could.”

60 Minutes Associate Producer, Jennifer MacDonald, went undercover with a camera to a number of CEC schools in their New York City location. At the Katharine Gibbs School (now Gibbs College), MacDonald was told graduation rates were 89% which exaggerated the actual 29% reported to the Department of Education. At another school, where she was told the school was “highly selective”, she did everything she could to disqualify herself; bad grades, drug use, and even purposely flunking the admission test, which the school then allowed her to retake with a score of 14/50 – this was enough to “qualify” her for enrollment.

“What CEC is most interested in is tuition. They want to say that the student comes first, but I think it becomes obvious to anybody that works in the school, that the student does not come first,” said Hanson.

STUDENTS FILE SUIT AGAINST BROOKS INSTITUTE

On February 5, 2005, Brooks Institute of Photography students Mark Nilsen and Antonio Limon filed a personal injury case against Brooks Institute of Photography/CEC. The lawsuit details that Brooks’ students were subject to high pressure sales pitches with misrepresentations of a 98% job placement rate, $75,000.00 starting salaries, a competitive application process, comprehensive job placement services, and an alumni network to assist the student in obtaining employment. [case no. 1165597]

This would later turn into a multi-school class action against CEC. This included Chanee Thurston from Brooks College in Long Beach, CA [filed in March of 2005] and Esther Outten from American Intercontinental’s 2004 lawsuit, asking for tuition refunds and punitive damages for violations of California’s Education Code, The Unfair Competition Law and Consumer Legal Remedies Act (CLRA). We will discuss the class action in length later in this report.

BPPVE UNDERCOVER INVESTIGATION

In late February 2005, California Bureau for Private Postsecondary and Vocational Education (BPPVE) sent an employee to Brooks Institute of Photography, posing as a prospective student. During the investigation she was told if she attended BIP, “She could expect her starting salary to be “$50,000 to $150,000”, in her first year after graduating – enough to pay off the debt she would take on as a student. “The sky’s the limit”, the admissions representative said of her prospects, according to the eleven page report delivered to Greg J. Strick, BIP’s then President. Including several violations in Brooks’ records, there was not one recent graduate who could report earnings close to the $50k earning potential. Out of the 45 graduates interviewed by CBPPVE, their average annual income was roughly $26,000, while their average student loan debt was around $74,000.

The BPPVE issued Brooks Institute of Photography a conditional approval to operate for the next two years, stating they would have to provide, “equitable restitution” to students going back to 1999; meaning, part of its conditional approval to operate, BIP was obligated to recompense all students enrolled from May, 1999, to the present [2005], and to stop enrolling new students. The school denied all allegations, and requested an administrative hearing to ‘present the facts’. The conditions would not go into effect until said hearing, which took place March 16, 2006.

“The Bureau has determined that an unconditional grant of approval to operate is not in the public interest.”

– Notice of Conditional Approval to Operate, by BPPVE in 2005 –

MAXINE WATERS CONGRESSIONAL TESTIMONY REGARDING CEC

On March 1, 2005, the House Committee on Education and The Workforce held a hearing on the Enforcement Of Federal Anti-fraud Laws In For-profit Education, regarding CEC in light of the 60 Minutes segment. Chairman John A. Boehner, Representative Maxine Waters, and other bipartisan U.S. Representatives were presented with witness statements’ regarding the fraudulent and misleading practices that CEC frequently engaged in, to profit from their students by abusing Title IV Funds.

“The level of damage to these students is far more severe, because of the enormity of the loans they owe, and the fact that their loans cannot be discharged in bankruptcy when the students are unable to pay. It sends a bad message when violations of financial aid law have so few consequences for a school which is caught, but the consequences experienced by defaulting students are many, and severe. Pure and simple, these schools ruin young adult’s lives, and steal their dreams. Yet for the most part, the Department refuses to follow up on leads that fraud and violation of the law exist.” – Maxine Waters – 2005

“Career Education Corporation misrepresented graduation rates, promised inflated salaries to prospective enrollees, enrolled students who did not have the ability to complete casework, and focused heavily on boosting enrollment numbers and Federal student aid payments. These actions represent a disservice to students, taxpayers, and those colleges that play by the rules and provide a quality education on a fair basis.” John Boehner said March 2005 to a US House of Representatives hearing on abuse in the student aid program and the proposed changes to the College Access and Opportunity Act, H.R. 609

BPPVE FINAL REPORT – BROOKS MISLED ITS STUDENTS

In June 2005, The National Consumer Law Center issued a report: Making The Numbers Count: Why Proprietary School Performance Data Doesn’t Add Up – echoing why the self-reporting proprietary schools, including CEC, are easily able to falsify numbers, and give inaccurate graduation and enrollment rates, in order to obtain Title IV funds for profit.

Contemporaneously, Santa Barbara News Press published an article Brooks Misled its Students, Report Says. According to the BPPVE report, Brooks Institute of Photography violated CA state-law, specifically, the Private Postsecondary Education Reform Act, and it could face denial of its authority to operate. Among other things, the agency accused the school of, “willfully misleading, falsifying and omitting critical information that persuaded prospective students to enroll in educational programs that were advertised and promoted as preparation for a high paying career in their fields.” Brooks also, “encouraged students to constantly apply and receive student financial loans in considerable excess of potential earnings to repay the money,” according to the report.

The report further stated that the school gave regulators performance data, “that was found to be inaccurate, incomplete and misleading.”

According to a July 2005 New York Times article: The School That Skipped Ethics Class, the BPPVE also found BIP presented false and misleading information on the availability of jobs, career placement services assistance for alumni, and the percentage of graduates gainfully employed in their field of study. The BPPVE had found violations at Brooks, even after the company had agreed to address problems identified in years prior.

FACULTY ALSO PULLED INTO UNLAWFUL AGREEMENTS

In September 2005, Bryan Farley, a marketing and admissions employee at BIP stated CEC changed the employment status of their employees, “introducing a different way to calculate hours worked (and by different, I mean illegal).” Bryan started to ask questions, cordially, but was only met with resistance from CEC administrators. He later reported CEC’s violation to the California Department of Labor Standards Enforcement. CEC eventually transitioned their employment status regulations to align with legal practices.

“I experienced my own problems with the parent company. In September of 2005, CEC announced that they were changing our employment status and introducing a different way to calculate hours worked (and by different, I mean illegal). From the beginning, I questioned the legality of the new arrangement. I began kindly. I continued cordially. Eventually, I went to the California Department of Labor Standards Enforcement (DLSE) and provided the legal opinions to support my argument. It still took CEC months to change their employment rules to reflect the law. … When it was time for me to leave my job, CEC encouraged me to sign exit paperwork that would limit my ability to speak publicly. I refused to sign. It wasn’t worth the money. They weren’t going to buy my silence, even though I remained quiet. As far as I know, I am the only one who refused to sign. I don’t know how regulators and journalists received most of their information. A few years ago, I thought that someone was trying to contact me. I never solved the puzzle. I might have been a little paranoid.” – BRYAN FARLEY – marketing and admissions department 2003-2008

MORE STUDENTS, LESS RESOURCES, MORE PROFIT

In late 2005, with annual tuition rates at $32,460 per student, Brooks Institute of Photography was near a total enrollment of 2500 students, over the seven campuses. Classes were overcrowded, there wasn’t enough equipment to provide to students, and program specific class offerings were few. Program directors and faculty were disheartened by empty promises and deflection in response to their quest for upgraded equipment and or software, and or classes that taught contemporary digital techniques.

ADMINISTRATIVE AND FACULTY INFIGHTING

Frustrated with rising tuition costs, lack of resources and equipment for students, and faculty infighting, some instructors reported feeling misled about their role and future at Brooks. Within the Visual Journalism Program, PF Bentley took the lead in vocalizing personal frustration with the institution, and their need of administrative transparency. Prior to teaching at Brooks, Bentley was a 20 year staff photographer at TIME Magazine, a White House Photographer during the Clinton Administration, and a leading visual journalist in the field. Brooks admissions recruiters would use the all-star, Pulitzer Prize winning faculty, three of whom were in the Visual Journalism program, as selling points to prospective students. P.F. Bentley was one such selling point, used to enroll new students- even after he was no longer part of the faculty roster.

“I could no longer ethically teach in a program at a school which the goal was to produce graduates for non-existent newspaper photographer jobs. The industry (and the world) was changing and David Litschel (DL) would not listen to faculty to evolve the Visual Journalism Department for our changing multimedia times. Newspaper photographer jobs were being cut drastically across the country.

DL would tell prospective students at the Open House gatherings that Brooks was cutting edge, but in reality would not upgrade software in the labs. I was written up in my end of year review for teaching technology not available to students and denied my annual raise. I had to contact CEC and threaten to go public, since my students in Real World [Photojournalism class] all had the upgraded Photoshop and didn’t work in the labs anyway. They changed my review and I got my raise. The year I was named ‘Teacher of the Year’. Figure that one out.

In my term off, I was shooting for Travel Channel and being praised for my professionalism and technical knowledge. The VP of Travel Channel told me I could work any show for him. That was it for me and I gave my notice at Brooks. Teaching was the easiest and most fun part of our jobs at Brooks, dealing and fighting with admin to better the education of the school took up most of our time. I gave my statement to faculty why I was leaving which told a lot of this story.”

PF Bentley – Brooks Institute of Photography Faculty – 2003-2006

2006

PROGRAMS CONTINUED TO RUN IN NON-COMPLIANCE

On February 14, 2006, according to faculty testimony, BIP was notified of an ACICS accreditation compliance visit. David Litchel, BIP’s Provost, gathered the Visual Journalism faculty, fully aware the program curriculum did not fulfill the classroom and lab hours required to receive federal funding, and asked them to falsify their reports to the accreditors, by overstating their class(es) size. While some instructors agreed to comply, some refused. Later, when a department [Visual Journalism] wide email was sent out about the ethics of asking journalism instructors to lie, Litschel replied with a retraction letting faculty know they were not “required” to lie. The issue became moot in the end, as ACICS never asked for the class size reports, therefore they never learned the school was operating in non-compliance. In 2016, ACICS was stripped of its accreditation abilities for allowing schools to operate against federal standards.

BPPVE Investigation thrown out on technicality

During an administrative hearing on February 3, 2006, Brooks Institute of Photography v. BPPVE, BIP argued regulators with the bureau failed to pull together “a visiting committee” of independent experts when inspectors visited the school in 2004 and 2005, a legal technicality of their own regulations.

On March 16, 2006, a California Administrative Law Judge Julie A Cabos-Owen, in a 16 page ruling, ultimately sided with CEC, with Brooks, being absolved of operating conditions and awarded an indefinite extension of its license. “CEC argued that regulators broke the law by improperly mixing permitting procedures with its rules of investigation.” BPPVE would have to start their investigation from scratch. Brooks President, Greg Strick, said they would not find any issues.

The investigation was never reopened.

Adding a little side note for further investigation. We have not yet pinpointed an actual date, however, we do know around the time the investigation was thrown out. California Senator Dianne Feinstein invested roughly a million dollars of her own personal money into CEC. Her husband Richard Bloom was a major investor at this time and sat on the CEC Board of Directors. It’s hard to imagine this being a coincidence.

In December 2005, American InterContinental University (AIU) was placed on probation by the Southern Association of Colleges and Schools. In response, John M. Larson, CEC founder and Board of Directors chairman, said CEC was conducting its own investigation. That following spring in April 2006, AIU London became the first and only institution in history to fail a Quality Assurance Agency routine accreditation inspection, which meant CEC was at risk of losing accreditation of its principal asset. Steve Bostic and other major shareholders then demanded change.

During a CEC shareholders meeting on May 18, 2006, CEC’s largest individual shareholder, Steve Bostic, created a scene where he encouraged other shareholders to demand voting rights, transparency, and to hold directors accountable “for CEC’s serious accreditation and regulatory problems and its declining enrollments and earnings.” Mr. Bostic first gained equity in Career Education Corporation in 2001 when they bought his for-profit university holding company, EduTrek International Inc., for $81 million. The firm based out of Atlanta, GA also operated American InterContinental University. John M. Larson (Jack), supported by other CEC executives, tried to reframe Bostic’s demands by saying that he was going “crazy” and didn’t fully understand the facts. Just prior to the May 18 shareholders meeting Bostic sent a letter to fellow shareholders urging them to vote for a new Board of Directors comprised of James Copeland, William Ide and himself, “to ensure effective Board oversight, and restore integrity and sound educational values to the company.”

In early 2006, the Securities and Exchange Commission closed its investigation into allegations that CEC had inflated attendance figures. This news was welcomed as shares fell from its peak of $70 to $31 over a two year period. However, the feeling didn’t last when the first quarter earnings showed a decrease in enrollment, and the annual forecast wasn’t positive. The shares dropped another 14% and shareholders were clearly upset over their losses, even after a wall street analysis claimed CEC had cleaned up its act, further showing they were not operating with their customers nor in the students best interest.

Bostic spent $2 million for his unsuccessful campaign to replace CEC Board Members. In response, CEC spent more than double the amount in shareholders money defending its practices. Expensive infighting was one of many ways CEC used their Title IV funded profits to cover-up their illegal business approaches.

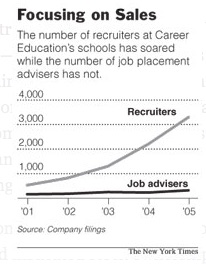

NYT provided a chart showing the number of recruiters that were hired compared to Career Services advisors at CEC education institutions. Using sales, increased enrollment, and loans issued to students as their recipe for success, CEC showed it was driven by shareholder interests and corporate tax-funded profits, instead of by students education.

SHAREHOLDERS KNEW THE ABUSE OF TITLE IV FUNDS MEANT MORE PROFITS

During the August 3, 2006 – CECO – Q2 2006 Career Education Earnings Conference Call, John Larson began by first addressing the stocks decline in value and how CEC planned to address the issue, “by hiring more admission representatives and providing bigger sales bonuses”.

Pat Pesch, the company’s CFO, in this same call, discussed loan approval being down and CEC finding creative ways to get around the new DoED co-signing standards. Their plan was to also reduce capital spending – corresponding with testimony highlighting Brooks’ neglect of campus upkeep, failure to update or provide equipment, and “firing” instructors, support and administrative staff in the years following. During the Q&A, Pesch discussed closing of as many as 20 underperforming campuses to boost gains.

“Look we certainly always put our shareholders first, and certainly our Board does too. We always want

to maximize shareholder value, so that’s always been our intent as a Board, and as a management team.”

– John M. Larson – Founder, President & CEO of CEC

During the Q&A of the same earnings call, in a conversation between Gary Bisbee, a shareholder from Lehman Brothers, and Pat Pesch, they discuss taking on more bad debt [students who are likely to leave the program and/or default on loans] in order to boost profits with Title IV funds, which would come as profits.

Gary Bisbee: Okay. That’s a fair answer. And then around the bad debt expense, I appreciate that you are focused on collections and credit quality and what not, but it seems to me that, like you’ve mentioned in culinary, it might be a wise decision to be willing to lose a little more money on some of these students to get them in the door and get the Title IV Funds, and it seems like that might be a really profitable endeavor, so I guess I wonder, bad debt at 2%, why not let it go back to 3.5 by—

Pat Pesch: Gary, if I wasn’t clear in my comments, I couldn’t agree with you more. We absolutely are looking at the kind of changes that would take on a level of credit risk that would be prudent, but clearly, I would expect that the changes we’re making would cause bad debt to go up higher, but hopefully will improve the top-line and improve the bottom-line because essentially it would allow us to leverage admissions and advertising spend, occupancy spend, even academic spending to the point of dealing with more fuller classrooms.

Gary Bisbee: Okay.

Pat Pesch: So that’s absolutely our intent.

John Larson: Look we certainly always put our shareholders first, and certainly our Board does too. We always want

to maximize shareholder value, so that’s always been our intent as a Board, and as a management team.

September 2006

Facing regulatory and legal issues, infighting between shareholders and C-level executives, founder, president and CEO, John M. Larson stepped down. Long time board member Gary McCullough was made the new CEO until 2015.

FACULTY PUNISHED FOR STANDING UP FOR THEIR STUDENTS – CHAOS ENSUES

CEC behaved as though nothing had occurred and instead set-up roadblocks to stop the Visual Journalism program faculty from expanding course curriculum or allow an updated syllabi to reflect the skills and knowledge necessary for students to be competitive in the job market. Several faculty members reached out directly to John King, the VP of Academic Affairs for CEC, bypassing Provost, David Litschel and Brooks chain-of-commands protocol. The faculty issued grievances against BIP’s administration, specifically about David Litschel. The faculty were met with apathy, or in the case of the Dean of Academic Affairs and Student Advocate Stuart Goldman, immediate dismissal. Faculty members’ attempts to create a union were resisted and conquered by CEC. And although most faculty were loyal to the school and believed in the stated mission of photography and film education, they disagreed with the direction in which CEC took the schools’ ethical practices. As a result, CEC replaced many program leaders and faculty with inexperienced and undereducated staff.

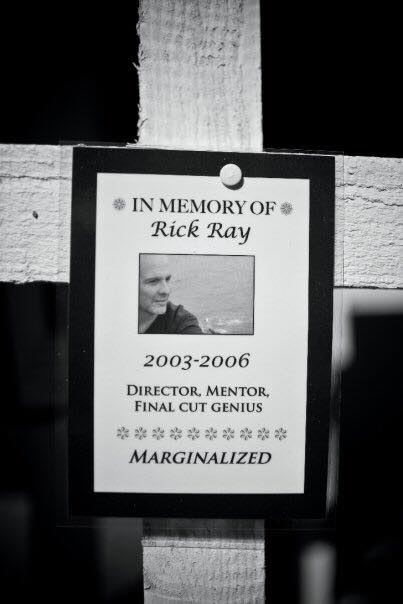

With a new session days away from starting, Brooks administrators refused to respond to multiple requests from Visual Journalism faculty Rick Ray, to have his contract renewed. Uncertain of his employment status Ray informed his students that he didn’t think there would be a class. It was only after this act that Ray received a response from the program director, Jim McNay who sent an email stating ‘You aren’t teaching here anymore.’

Another VJ faculty member, Brent Winebrenner, quit in protest due to Brooks’ deteriorating quality in both education and support to its students.

“I left voluntarily but the writing was on the wall. It was the Friday before classes were to start and I had still not heard from him [Jim McNay, VJ Program Director & or David Litschel, Provost]. So I emailed my student list and told them I was unsure of whether I was teaching there anymore or not. Then McNay sent me an email saying ‘you aren’t teaching here anymore’. So I informed the students and they organized a “strike” on the campus until I was reinstated. This included making up coffins and having a mock funeral for all the fired faculty the students lost for the prince of their tuition. Finally, after what I think was a week or so of general strikes and chaos, I was reinstated and started the semester a week behind. Eventually, the plan became to just hire grad school people with a degree in education rather than industry professionals – a big undercutting of value for student tuition. It was a crazy time. Most of us loved the students, our fellow faculty (many of whom are highly regarded in their fields), the camaraderie and personal relationships between ourselves and our students. But the relationship with the administration of the school was so chaotic and consistently divisive, it was hard to keep your mind on teaching. At one point we tried to unionize, and you can imagine how that went over. Then we tried to form a faculty senate, which was also opposed.” Rick Ray – VJ Faculty – 2003-2007

2007

In January 2007, students at the Ventura campus returned from winter break and quickly began organizing protests in response to the rapid firing and degradation of education. Asking for transparency and answers from the schools President, Greg Strick. Students wanted answers as to why the leading teachers were systematically being fired. Since Brooks Institute did not have an ombudsman or a student body government nor a Student Advocate the students could turn to, they galvanized from across the many campuses and programs to demand accountability from Brooks operating administration.

President Greg Strick, met with a group of students after a Petition for Accountability and Integrity had been circulated throughout the seven campuses as a result of faculty dismissals, dwindling resources, and insecurity of the institutions future. In an audio file Strick clearly tries to smooth things over and assure students that it was all just a misunderstanding and that the teachers left not because of the controversies, but because they found better opportunities and left on their own accord.

The conversation continued as students brought up the fact that they enrolled at Brooks Institute to get an education from the best instructors, who were all being “let go” or fired. After all, that was what the students had been promised. The students demanded transparency and a timeline as to when a plan to ‘fix’ these issues would take place. They asked, just as they did four months prior, to be able to establish a student government to keep students informed of what was happening with the administration by opening a channel of communication to the administrative staff and also have direct self-governance for their education. Strick continued to sidestep the accreditation allegations, deflecting a direct answer at every challenge. However, the students were successful in their organizing and a “student government” body was formed as a result. Initially called, Brooks Institute of Photography Student Coalition, designed to give students agency and advocate for their own needs. This seemed to pacify the initial student unrest and Rick Ray was temporarily reinstated, but students directly involved express that their concerns and needs were never truly addressed.

Though the student tension simmered down, faculty began to organize. Several VJ faculty members organized a faculty meeting at the Marriott Hotel (referred to as the “The Marriott Meeting”) to discuss the need for David Litschel’s immediate removal. They intentionally excluded Jim McNay (VJ Program Director) and David Litschel (BIP Provost) from the invite. There was much division within the program regarding which direction it should take. Many of the faculty members were loyal to the school and Jim McNay and did not want to cause dissent. Others were angry that their needs as teachers were not being facilitated, and that students were not getting the education they were paying for and promised.

On July 2, 2007, Greg Strick, BIP President, stepped down and Interim President Roger Andersen was transitioned from his position as VP of Operations in order to rebrand and reshape the image of BIP. Brooks Institute of Photography was renamed Brooks Institute sometime in late 2007 or early 2008 following Andersen’s change in position.

Jim McNay, the Visual Journalism program director, resigned as program director during a public faculty meeting. According to several faculty members, when it came time for CEC to step in and keep the at-will faculty members from stirring the pot, it was he who took the fall for the Visual Journalism upset. In 2000, McNay was hired to develop the Visual Journalism (VJ) program at BIP, from San Jose State University, one of the nation’s leading schools in photojournalism, where he had been a long-time instructor. McNay built Brooks’ Visual Journalism program from the ground-up, assembling the VJ faculty dream-team, which recruiters used to sell the school to prospective students. Ultimately, he was used as a scapegoat and a warning to others to not contest the authority of CEC.

Late 2007

BROOKS BORROWERS ARE NOTIFIED OF CLASS ACTION

In late 2007, BIP Borrowers were notified of a class action lawsuit that had started in 2005. This class action, argued by The Braun Law Group, also included two other CEC owned schools, Brooks College and Los Angeles Campus of American Intercontinental University. Most Borrowers, at this point, were struggling to pay their loans and had little to no job assistance or prospects, as originally promised by the school. For those aware it was happening, the lawsuit was a sliver of hope for potential relief. For those who weren’t aware it was a divisive limitation to their future possibilities. On the small card sent by an obscure law firm there was an area to opt out of the class action suit, however many students did not understand they needed to respond and even more thought it junk mail or an unwanted solicitation. Very few students opted-out. The language in the class action lawsuit stated that anyone who attended Brooks Institute between 1999 and 2007 and did not physically opt-out were considered part of the lawsuit and could not enter or start another lawsuit against CEC. The settlement wasn’t issued until 2009.

2008

BROOKS CONTINUES TO DOWNSIZE AS ENROLLMENT DROPS: AND OTHER CEC CONTROVERSIES

As controversy spread, the 2008 recession hit. Enrollment dropped, CEC continued layoffs and cut funding for essential resources in order to meet shareholders profit expectations.

In San Francisco, another CEC school, California Culinary Academy, was accused of misrepresenting the quality of its program as well as overstating job placement and availability to the Academy’s graduates. The suit also accused the Academy of accepting bonuses from student loan companies if they successfully placed students in loans that exceeded market rates.

February 27, 2008, the Pennsylvania Attorney General, Tom Corbett, reached a $200,000 settlement agreement with CEC regarding allegations that CEC owned schools had conned students into taking high-cost private student loans. The settlement covered the cost of the investigation but did not hold CEC accountable for fraud or forgive students’ (fraudulent) debt.

In May 2008, CEC started to consolidate and sell off Brooks Institutes’ historic properties. The first to go to market was the Montecito Campus, Brooks Institute of Photography’s original campus. The property was conservatively estimated to sell for $9.5 million. It is unclear how long it was on the market, as the stock holding companies show it was sold internally from “Brooks Career Education Institute Of Photography, Inc.” to “CEC Real Estate Holdings.” It finally sold to a private owner for $6.2 million in 2011. Several other campus buildings in Santa Barbara were closed and or sold, eventually moving the entire school to the Ventura, CA campus by 2014.

2009

BROOKS CLASS ACTION SETTLEMENT A WIN – LOSE

Early 2009, the Brooks Borrowers who participated in the three-school class action against CEC received their settlement to much disappointment. While the entire settlement was for $12,250,000, most received checks that covered less than one month’s loan payments ($1200). While some received more it was not close to the mountain of debt they were on the hook for, which was growing daily with compound interest. After legal fees and disbursement between thousands of students from three different schools were paid out, it is hard to imagine CEC did not strategize this as a way to make it impossible for other students to pursue further legal action against them. Even with legal obligation to pay the $12,250,00 settlement, CEC admitted no wrongdoing.

In November 2009, NEWSWEEK published an article – COLLEGE STUDENTS HIT BY HIGH-INTEREST LOANS – and reported on CEC/ Brooks Institute, identifying their practice of issuing borrowers high-interest loans.

2010-2016

In August 2011, former Brooks student Todd Marek, along with his mother and grandmother who were his cosigners, filed a lawsuit against Sallie Mae for his student loans. They ballooned from $120,445 to more than $227,000 due to hidden terms and fees and for Sallie Mae associates forging his mother’s signature on several of the loans. There is no more accessible information on the case because it was either dismissed and/or is in a court of appeals process as a non-disclosure was signed in 2014.

In 2014 the largest for-profit corporation, Corinthian Colleges, Inc, in North America was on the brink of collapse after many allegations of defrauding their students. The federal government restricted financial-aid payments to the company after it failed to provide the department with accurate records on job-placement and attendance data and the Obama Administration enacts the Gainful Employment Rule. This new GE rule was designed to ensure that career-education programs leave their graduates with debts that are affordable relative to their actual incomes. It distinguishes between programs that provide affordable training that leads to well-paying jobs and those that do not, based on the debt-to-income ratios of their graduates. For-Profit schools scramble and shut their doors after failing to operate under the new rules.

Brooks attendance dwindles down to only 522 students.

CEC OFFLOADS BROOKS

CEC struggled to perform under the new federal guidelines, lack of access to federal funding, and enrollment down to roughly 300 students. On June 18, 2015 Brooks Institute was acquired by a Chinese education company based in Massachusetts named GPhomestay [rebranded to The Cambridge Network] for $600k. CEC was so desperate to to shed it’s liability it paid GPH to take it.

ASICS LOSES ITS ACCREDITATION STANDING

On December 12, 2016, the DoED announced it no longer recognized the ACICS’ accreditation abilities as a result of the agency not following federal guidelines, by ignoring substandard education, and allowing questionable ethical standards to persist in schools, all of which encouraged ‘diploma mills’ for-profit. Schools were responsible for paying for reviews and accreditation, which in turn engendered a business-partnership rather than an oversight committee.

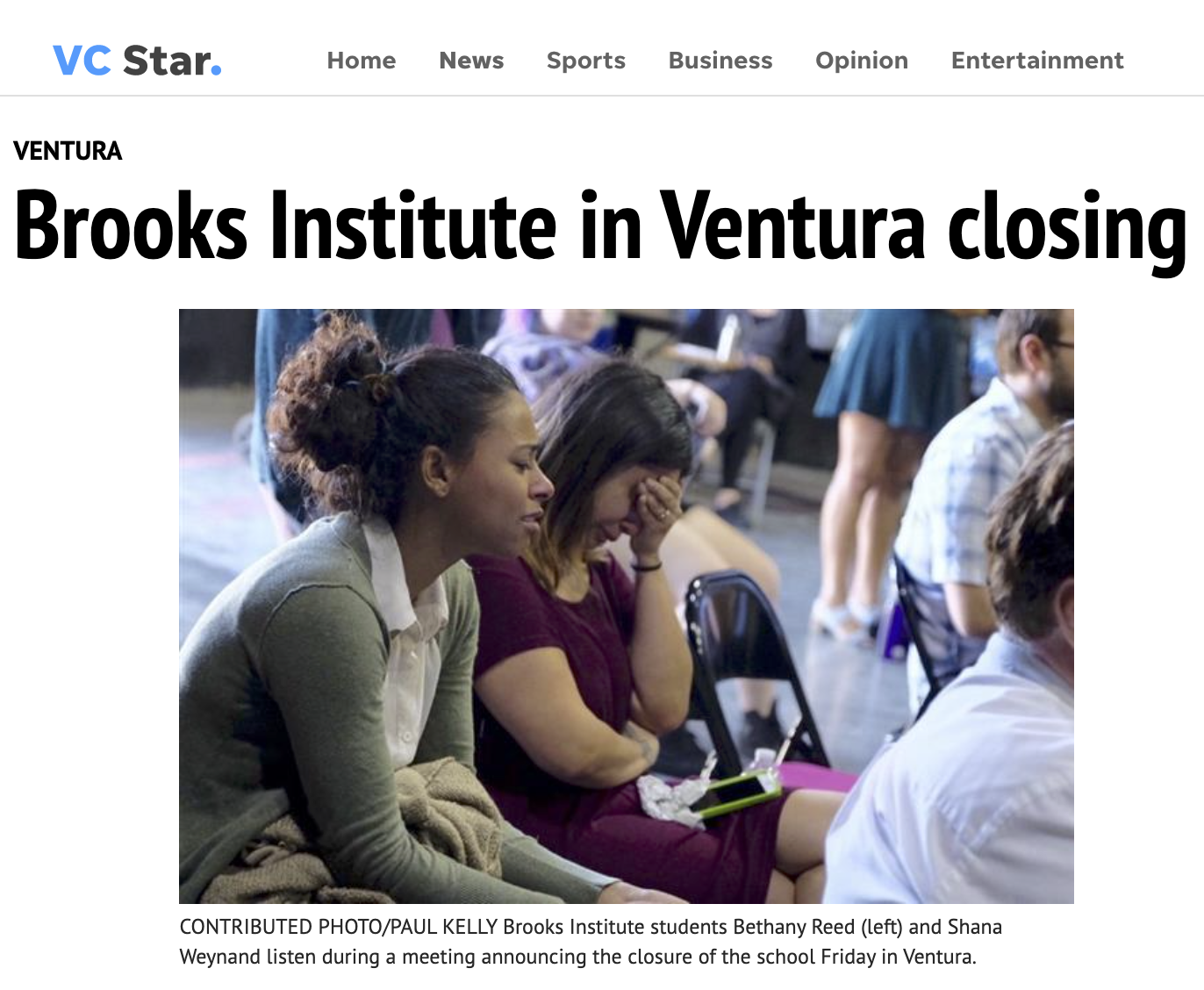

BROOKS SHUTTERS on 70th ANNIVERSARY

After owning Brooks Institute for a little over a year and entering a contract with the city of Ventura, CA to open a new consolidated campus in the heart of downtown, school officials ousted President Edward Clift. Several Board Members resigned and GPhomestay announced on August 12, 2016 that Brooks Institute would be shutting their doors permanently, leaving current students scrambling. Brooks Institute broke its contract(s) in addition to owing the city of Ventura over $70,000 and costing tax payers over $825,000.

Brooks Institute officially closed its doors on October 31, 2016, the eve of its 70th anniversary

CEC CONTINUED PROFITS, ONGOING SETTLEMENTS & MARKET CAP OF $1.3 BILLION

CEC’s reporting of continued profits and increased revenue demonstrates how minimal the effect the states’ attorneys general lawsuit(s) had on the shareholders. CEC’s ability to continually settle a multitude of similar lawsuits veiled in non-disclosure agreements, coupled with never having to admit wrongdoing, is a red flag for endemic illegal and fraudulent behavior. Despite the controversies and litigations CEC continues to gain substantial profits from their many umbrella institutions. Todd Nelson’s CEO salary of $7.2 million annually exhibits the gratuitous earnings executives grossed, in contrast to similarly-sized organizations that provide average salaries of $3.6 million. Hundreds of CEC shareholders received a return of 236% over the last three years, while hundreds of thousands of defrauded former students were left financially destitute. Students were without viable, consistent income or ways in which to return to school to seek out another career, as they had already received the maximum amount of loans available to them.

2017/2018

Trump & Betsy Devos deep CEC connections

Betsy Devos was nominated as the secretary of education in 2017 by president Trump and served until 2021. She was responsible for pushing deregulations of for-profit schools, many of which she had ties to. Adding insult to injury, former CEO’s of said schools for profit were then appointed by Devos to serve in the Department of Educaiton. According to republicreport.org, “Acting Under Secretary of Education Diane Auer Jones was from 2010 to 2015 senior vice president and chief external affairs officer at CEC. Robert Eitel, senior advisor to DeVos at the Department, was vice president of regulatory operations at CEC from 2013 to 2015. And the acting head of the Department’s student aid office, James Manning, was, sometime between 2015 and 2017, a consultant to a student loan company run by William Hansen, who now sits on the CEC board of directors; Manning was Hansen’s chief of staff when Hansen served as deputy education secretary under George W. Bush.”

As part of Devo’s corrupt rule at the Department of Education moved forward with reinstating ACICS, an accrediting institution which had been previously suspended of their right to provide accreditation due to previously lax implementation of regulations at for profit schools. She then removed protections for students including the gainful employment rule which provided information for potential borrowers about the program they were signing up to and its job placement rates. DeVos, in much delight to the for-profit industry, then developed her own new rules for Borrower Defense making it almost impossible for borrowers to make their case.

On April 4, 2020, In one of only a small handful of bipartisan agreements under the Trump administration, 10 Republican Senators joined Democratic Senators in voting 53 to 42 for S.J. Res. 56, which overturns the Department of Education’s revision of the 2019 Borrower Defense to Repayment rule. The victory was quickly lost when Trump used his executive order to veto the overruled measure. The new rules went into effect July 1, 2020.

Additionally, she moved forward with gutting the BDTR department which was processing loan forgiveness applications for students who had been defrauded by for profit institutions. This caused a complete standstill in the application process.

CEC’s CEO, Todd Nelson, announced: “2018 was a watershed year for our company, with operating income the highest it has been in almost a decade.” He added, “Our balance sheet is expected to further improve in 2019…”

2019/2020

49 Attorneys General Announce Half Billion Dollar Multistate Settlement with CEC

On January, 3, 2019 – 49 States AG announced a settlement with CEC. The settlement requires CEC to forgo any collection efforts against $493.7 million in outstanding loan debt held by nearly 180,000 former students of mostly from their American InterContinental University and Colorado Technical University schools. It also imposes a $5 million fine on the company and no longer enroll students in programs that do not lead to state licensure when required for employment, or that – due to their lack of accreditation – will not prepare graduates for jobs in their field.

An investigation into CEC was launched in January 2014 after receiving several complaints from students and a critical report on for-profit education by the U.S. Senate’s Health, Education, Labor and Pensions Committee.

The attorneys general alleged that CEC pressured its employees to enroll students, made misleading statements, and failed to disclose information to prospective students on total costs, transferability of credits, program offerings, and job placement rates.

California was not involved with the settlement and no Brooks Borrowers received relief.

In September CEC paid $30 million to settle Federal Trade Commission charges of using deceptive third-party lead generators. The FTC described the shortcomings as follows: Numerous websites and advertisements have induced consumers to submit their contact and other personal information under the guise of providing consumers with completely unrelated services such as military recruitment, assistance with job searches and applications and government benefits. These websites have not sought consent for CEC or its lead generators to call consumers, nor disclosed that the purpose of any call would be to market post-secondary or vocational education.

On January, 3, 2019 – 49 States AG announced a settlement with CEC. The settlement requires CEC to forgo any collection efforts against $493.7 million in outstanding loan debt held by nearly 180,000 former students of mostly from their American InterContinental University and Colorado Technical University schools. It also imposes a $5 million fine on the company and no longer enroll students in programs that do not lead to state licensure when required for employment, or that – due to their lack of accreditation – will not prepare graduates for jobs in their field.

An investigation into CEC was launched in January 2014 after receiving several complaints from students and a critical report on for-profit education by the U.S. Senate’s Health, Education, Labor and Pensions Committee.

The attorneys general alleged that CEC pressured its employees to enroll students, made misleading statements, and failed to disclose information to prospective students on total costs, transferability of credits, program offerings, and job placement rates.

California was not involved with the settlement and no Brooks Borrowers received relief.

In September CEC paid $30 million to settle Federal Trade Commission charges of using deceptive third-party lead generators. The FTC described the shortcomings as follows: Numerous websites and advertisements have induced consumers to submit their contact and other personal information under the guise of providing consumers with completely unrelated services such as military recruitment, assistance with job searches and applications and government benefits. These websites have not sought consent for CEC or its lead generators to call consumers, nor disclosed that the purpose of any call would be to market post-secondary or vocational education.

SWEET v. DeVos

On June 25, 2019 Harvard Law School’s Project on Predatory Student Lending, Housing and Economic RIghts Advocates of California (HERACA.org) , and Brooks Graduate Theresa Sweet filed a lawsuit against Betsy DeVos and the Department of Education for stalling the processing of BDTR applications. By October the courts granted class-action status for an additional 200k borrowers stuck in the BDTR pipeline.

April 10, 2020 – Settlement was reached. The DOE has 18 months to process applications submitted before April 1, 2020. The DOE must not collect on the debt while the application is processed and all interest accrued must be credited back. If the DOE does not comply the borrower receives debt discharge of 80%. The DOE must report every 90 days.

May 21, 2020 – The judge granted preliminary approval of the proposed settlement.

June 2020 – DeVos “blanket denies” 94% of BDTR claims; most class members receive denial letters

September 17, 2020 – Motion was filed to enforce settlement.

October 1, 2020 – Public Fairness Hearing. Unprecedented 500 attendees via zoom. Many Brooks Borrowers stood up and shared their stories. Several hundred class members used the chat to tell their stories, commiserate, and plead for justice. The court allowed the zoom chat to be filed as official court document.

October 19 2020 – Judge files order denying settlement, for discovery in both documents/depositions and for the DOE to stop issuing denials. Calls the mass denials ‘Disturbingly Kafkaesque’

“The Secretary’s perfunctory denial notice does not explain the evidence reviewed or the law applied. It provides no analysis. And, the borrower’s path forward rings disturbingly Kafkaesque.”

-U.S. District Judge William Alsup

CEC rebrands to Perdoceo

On January 1, 2020 due to decades of controversy, lawsuits, and tarnished reputation as a for-profit ‘bad actor’ CEC – Career Education Corporation – rebranded as Pedoceo. The company began trading under the new Nasdaq ticker symbol, PRDO.

Their net income in 2020 was $124 million. You can find a list of their current shareholders here.

2021

DeVos resigns & Biden takes office

January 7, 2021 – DeVos resigns from office, 13 days before Joe Biden and new administration is ushered in. DeVos resigned in protest after pro-Trump mobs stormed and ransacked the U.S. Capitol, staging a riot that left five people dead the day before.

Biden made campaign promises to forgive at least $10k student loan debt across the board and forgiveness for borrowers from bad actor for-profit schools. Many are skeptical due to his voting history and comradery with the lending industry.

Sweet vs. Devos Continues

January 11, 2021 – Letter filed requesting deposition of DeVos for discovery.

March 1, 2021 – Miguel Cardona confirmed as new secretary of education. Case changes name to Sweet vs. Cardona

March 18, 2021 – Plaintiffs’ filed an 600 page Amended Complaint citing new evidence that the U.S. Department of Education not only illegally delayed processing borrower defense claims, but created a sham process designed to deny borrowers debt relief regardless of evidence.

May 19, 2021 – DeVos motion to quash is denied. Judge, “this order impresses upon the parties that our failed settlement and term of discovery have delayed the just resolution of this case long enough already. Diligent haste will be expected.”

June 2021 – The DOE starts approving BDTR claims for select bad actor schools. ITT Technical Institute, American Career Institute, Corinthian Colleges, Westwood College, Marinello Schools of Beauty and the Court Reporting Institute. None of these schools were owned by CEC.

July 6, 2021 – Project on Predatory Lending founder, Toby Merrill, has been hired by DOE to serve as deputy general counsel.

BIDEN’S NEGOTIATED RULES COMMITTEE BLOCKS FOR-PROFIT BORROWERS

On October 4, 2021 Theresa Sweet is nominated to sit on the new Negotiated Rules Committee or commonly referred to as NegReg is a process in which stakeholders—including students, institutional representatives, and state and nonprofit enforcement agencies—collaborate with the Department on how to improve policies that impact students. This year, the broken borrower defense process is one of the top areas of discussion. While she had more than enough signatures, she was denied a seat as a conflict of interest due to the ongoing Sweet vs DeVos [Cordona] lawsuit. Two other Brooks Borrowers, Ashley Pizzuti and Evelyn Cervantes were also denied seats as the voting was by consensus and Jessica Berry, the one seat to represent the for-profit industry, voted no. There were no for-profit borrowers at the table to help shape the new Borrower Defense rules.

Continued Research

Here is an ongoing list of our continued reserach.

2000-

- What partnerships were formed between CEC, banks, and loan providers?

- Further investigate Sallie Mae’s relationship with CEC

- Were their incentives for schools to push one lender over another?

- How does Stillwater National Bank & Trust play a role?

- John Calman was President of Brooks Institute of Photography from 1999-2003 at the start of the CEC take over, why did he leave?

- Chart of CECs use of TITLE IV FUNDS

2004-

- Investigate more into the ACICS audit and stock options.

- INTERVIEW: Ms. Wingerden, Cecilia Schneider, and David Litschel

- Who are the shareholders? – Richard Blum, Dianne Feinstein are major players.

- How much did Dianne Feinstein invest total?

- Did Dianne Feinstein’s political power have any influence?

- How much were shareholders earnings and top Executives being paid.

2006-

- We have yet to obtain a copy of the official BPPVE case/ ruling information regarding whether the investigation was ever restarted.

- Senator Dianne Feinstein and her husband Richard Blum [separately] were major investors of CEC at the time of this controversy. There was a million dollar investment made by Ms. Feinstein relatively close to this court date, while we have not pinned down the exact date. We are curious if her influence had anything to do with the outcome of this ruling.

- Provost David Litschel received a large bonus just after the ruling in which he purchased a convertible Porsche while toting financial strain and budget concerns to the program directors.

- ACICS history and regulation – How much tax funds were funneled through?

- ACICS Executive director Steven A. Eggland, Created a report clearing Brooks of allegations. Five-member investigating team. WHO? Were any of them investors of CEC?

- What kind of bonuses and/or incentives were admissions representatives receiving

- Lehman Brothers were major shareholders. How did their collapse affect CEC?

- They mention not paying income tax in the call – Did CEC pay their taxes? What cuts did they get to avoid taxes?

- Who is Greg Cappelli with Credit Suisse – 2005 shareholder earnings call?

- John Larson’s departure – What was his parting severance, and why did he step down, or was he fired?

- Where is John Larson now?

- How did Gary McCullough take Larson’s place? What was his net gross? Where is he now?

2007-

- Who was Traci Christman’s Teacher – Get her to mail me the copy of the project. How much does she still owe?

- More on John King and his role between CEC and Brooks. Where is John King now?

- Interview Stuart Goldman – Termination, relationship with John King

- Interview Jim McNay – VJ Program Director

- What was happening with faculty in the other programs at this time?

- Interview Daniel Smith – Career Services, Film, Ventura Campus – Did little in ways of job placement but spent his days trolling people on the internet, he still according to many.

- Yvonne Check – Sr. Financial Aid Officer , Ventura Campus – Open to being interviewed and willing to help our case.

- Interview Greg Cooper – VJ Faculty – 2003 – until Brooks shuttered in 2016

- In 2007, the school changed its name to Brooks Institute, from the Brooks Institute of Photography. What was the rebranding process?

- What happened to Greg Strick? How/why was he fired? Where is he now?

2009-

Was the Braun Law Group connected to Blum/Feinstein? Did they use their influence to protect their investment?

- How much did Mark Nilsen and Antonio Limon get from the CEC settlement?

- How did they reach that settlement?

- Who was the judge for the class action? Were there investment connections?

- What were CEC Profits? What did executives make?

- Private Education Loan known as a CEC Signature Loan – Stillwater National Bank and Trust = Sallie Mae AND CEC

- Who are “Brooks Career Education Institute Of Photography, Inc.” “CEC Real Estate Holdings”

- Find Todd Marek

2010 – CEC profit was $246 MILLION the CEO, Gary E. McCullough, made $4,923,791 {source}

2010- Diane Auer Jones hired by CEC as Vice President of External and Regulatory Affairs {Source}

2010 – President Roger Andersen steps down – Why? {source}

2011- Major complaint against CEC officers for abuse of power, gross mismanagement, and abuse of control {source}

2011 -Two class action lawsuits against CEC and its school, California Culinary Academy – $40 Million Settlement {source}

2011 – CEO of CEC resigns as allegations mount and regulations tighten {source} {source}

2011 – CA WATCH – ‘For-profit education company inflated job placement rates’ {source} {source}

2011 – Brooks students vs Sallie Mae

2011 – PF – Quote in VC Star about brooks downfall {source}

2012 – Student council was coached by Gail Fisher, then head of VJ – to say what WASC accreditors needed to hear in

2012 – Class action against CEC by stockholders CECO Securities Stock Fraud is filed {source} {s2}

2012 – $20 million class action lawsuit settlement over allegations it sent unsolicited text message ads. {source}

2012- CEC Closes 23 campuses cuts 900 jobs {sources}

2012 – CEC-&-SANFORD-BROWN-COLLEGE Class Action {Source}

2012 – CHICAGO TRIBUNE on Ex CEO of CEC {source}

2012 – Florida AG is investigated CEC to “determine whether they have violated Florida law prohibiting {source}

2012- Judge Tosses Duplicate Claims Against CEC School {sources}

2013 – CEC Reaches $10 Million Settlement In Investigation Of Bogus Job Placements in NY. {Source}

2013 – New CEO of CEC to take home $4.8 Million in compensation {Source}

2013 – $40 Million settlement for Le Cordon Bleu/CEC Class action {Source}

2014 – A former CEC employee blows the whistle – Englehart v. Career Education Corp. {source}

2014 – $27,500,000 Securities Fraud Class Action Settlement against CEC {source}

2014 – Washington Monthly – Worst schools in US – Brooks Institute is #7 {source}

2014 – CEC Higher Ed False Claims Act Suits ‘Courthouse revolving door’ {source}

2015 – CEC were under heightened federal cash monitoring because of noncompliance {source}

2015 – National Consumer Law Center report {source}

2015 – New CEC CEO Todd S. Nelson {source}

2015 – CEC to shut down/sell nearly all campus under ne new for-profit regulations. {source} {source}

2015 – Brooks Institute was sold off to Gphomestay

2016 – Law Enforcement Investigations and Actions Regarding For-Profit Colleges {source}

2016 – February the Ventura, CA City Council approved a five-year lease for Brooks downtown property {source}

2016 – Brook Students form FB group and apply for Borrower Defense for Repayment Program {source}

2016 – WILSON v CEC back pay for recruitments {source}

2017 – MARCH Secretary of Education Betsy DeVos appointed Robert Eitel, a former CEC vice president, as an advisor. {source}

2017 – MAY Lobby group California Association Of Private Postsecondary Schools sues DoED over BDTR regulations {source}

2017- JUNE Secretary of Education Betsy DeVos to rollback Defense for Repayment Regulations {Source}

2017- JULY 6 Massachusetts Attorneys General, Maura Healey plus 18 other AG file suit over DFRP program {source} {source}

2017 – JULY 7 DoED responds to Lawsuit {source}

2017 – AUG – 1,285 official BDTR claims are made against CEC [thousands sit un-reviewed] {source}

2018 – Carlos G. Muñiz a lawyer who provided consulting services to CEC appointed as the DoED general counsel. {source}

2018 – DeVos to dismantle Unit Investigating Fraud at For-Profits {Source}

2018 – Democracy Forward sues DeVos over conflict of interest in delaying BDTR {source}

2018 – Students win refunds against Western Culinary Inst./Le Cordon Bleu Portland {source}

2018 – Ventura wins settlement with GPhomestay after abruptly shutting down school mid rebuild in the cities square. {source}

2019 – 37 States’ AG Settle lawsuit against CEC {source}

Misc – Brooks was holding onto loan payouts that were dispersed to the school for living costs for an extended amount of time. Possible Embezzlement.