Borrower Resources

While this is a collaborative effort, you must become your own advocate if you want to see any resolve to your personal situation.

FACE THE LION

Being buried under crushing debt is both terrifying and exhausting. There are many resources presented below that can help you navigate your predatory student loans. We are not lawyers and can not give you legal advice. This is going to be emotionally taxing, but time is not on your side. We are actively pursuing several legal avenues. We cannot guarantee those who wait to take action will be included in our efforts.

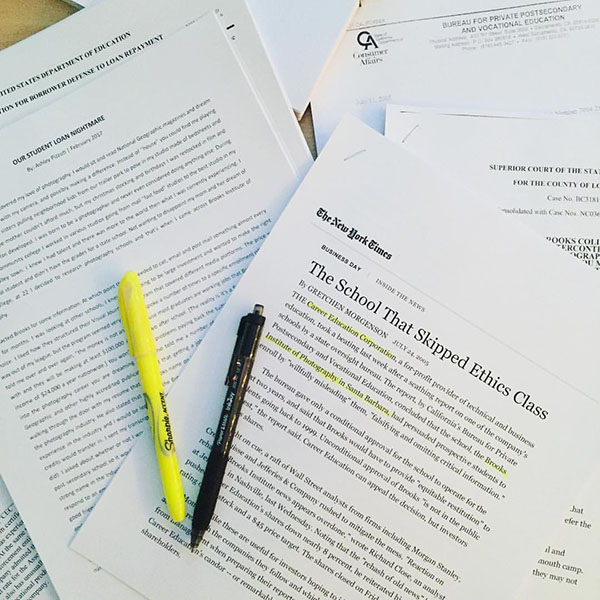

GET ORGANIZED

Create a folder on your computer/cloud to organize everything you find here that applies to your specific period of enrollment or that you would like to use in your defense in a lawsuit or application for Borrower’s Defense to Repayment. Google Drive and Dropbox are some of our recommendations. As you gather all your loan information put it all in one place so you may access it easily.

TAKE ACTION

While we are making efforts as a group, You are responsible for managing your loans and fixing your personal situation. We are a very small group. Every person who takes action on their loans makes the group that much stronger. Time is not on your side. Please consider starting today.

Know your loans

How much do you owe and to whom? Federal and Private loans are governed by very different laws.

Loan forgiveness and litigation options depend on the exact type of student loan/s you have.

– // Loan Types & Credit Monitoring // –

Federal Student Aid

Your federal loans and their status will be listed here. You can find your servicer and manage your consolidations here. studentaid.gov

Private Loans

Private loans originate with a bank, credit union or online lender. They follow a separate set of rules, regulations and consumer protections and are considered time-barred debt.

Credit Monitoring

Your credit history will show who is sending information about your loans to various credit reporting agencies, and can help you determine whether or not they are private or federal loans. We recommend creditkarma.com

Know your rights

Borrowers Defense to Repayment

Filing Complaints

Private Loan – School Misconduct

Statute of limitations

Legal Aid & Advocacy

Student loan Bill Of Rights

Borrower Defense to Repayment

Borrower Defense to Repayment is a program through the Department of Education that stipulates that your federal student loans can be discharged (forgiven) if your school engaged in activity that violated state laws, such as giving you false or inflated graduation and job placement rates.

Currently, BDTR is the only program that will allow Borrowers a reprieve from the burden of federal student loans taken out to attend scam schools. Critically, it may also help set a precedent to pursue legal action against repaying our private loan as well.

BDTR HOTLINE: 855-279-6207

Applying for BDTR

STEP 1 – GATHER YOUR DOCUMENTS

- Transcripts can be found at parchment.com

- Download files from the Evidence Catalog

- Find any paper documents you may have saved.

- Find any old Brooks emails

- Download our Brooks White Paper

STEP 2 – FILL OUT THE APPLICATION

I have created a step-by-step guide based on the current Federal Student Aid website and guidelines. This will walk you through the entire process and frequently asked questions.

DOWNLOAD THE BROOKS BDTR GUIDE

Sign in or create an account then follow the steps. studentaid.gov/borrower-defense

Save and/or print a copy of what you have submitted for your records. Including the confirmation email.

APPLICATION ISSUES

The application can get buggy and will time out, you will lose all your work along the way. Make sure to write both questions and answers in a separate doc so you can copy and paste them if you have to submit again. You may also need the answers for other forms of relief.

The website only allows for 5mb of evidence which is never enough. Submit your most completing with your application. Once you receive your confirmation email, you can reply back to that email or login to your studentaid.gov account and find your application. They should have an option to add to your application.

STEP 4 – FOLLOW UP

Within a few days, call the DOE BDTR hotline to make sure they received your application. Write down your Application ID and keep it with your files.

855-279-6207

You can add more files anytime by emailing the DOE with your application ID in the subject line.

Save your application often and write the questions and your answers in a separate document!

Direct Loan Consolidation

DIRECT LOANS

For your loans to be canceled through BDTR they need to be a direct loan or Parent PLUS loan. This means the Government holds the loans, not just federally securing them. Legally they only have the authority to cancel loans that belong to the DOE and those banks need to be paid by them first.

CONSOLIDATE TO DIRECT LOAN

If you do not have a Direct loan you will need to consolidate your loans into a direct loan. This is a pretty simple process you can do right in your studentaid.gov account. https://studentaid.gov/loan-consolidation

You don’t need to do this before you complete your BDTR. The consolidation of loans should be approached with care and consideration of individual circumstances. Consolidation might be beneficial in situations involving more than one school, but if you are not applying to BDTR for both schools, you may want to only consolidate those loans associated with the school you are applying for. It is vital to research and understand the best options for individual situations, as consolidation may have impacts on other forgiveness programs, such as the PSLF payment counts.

If you have consolidated NON-Borrower Defense loans together with Borrower Defense loans, they will be separated out and only the Borrower Defense loans will be canceled. It just may take your server an extended amount of time for the cancellation to reflect in your account.

Filing Complaints

How to file a complaint

The only way we are going to get any relief is by getting loud. Not only do you help yourself when you file a complaint, you help the mission as a whole by bringing attention to our cause.

Here are several places you can file complaints, many of these have step-by-step guides that walk you through the process, while others are direct links.

Private Loan – School Misconduct

Basic Steps for School Misconduct:

While this is developing information you will always find the latest information and FAQ on PPSL.org website or the Private Loan BDTR FaceBook Group.

- File a complaint with the CFPB and specifically state you feel you were misled by Brooks Institute into taking this debt and you would like a ‘School Misconduct’ application.

- You should receive an answer within 30 days.

- Fill out the application using the same EVIDENCE CATALOG as you would for Borrower Defense to Repayment.

- Please let us know if you get approved or denied info (at) brooksborrowers.org

Statute of Limitation

What is the statute of limitations?

SOL IS ONLY FOR PRIVATE LOANS. THERE IS NO SOL FOR FEDERAL LOANS.

The Consumer Finance Protection Bureau (CFPB) defines the statute of limitations on debt as: “The limited period of time creditors or debt collectors have to file a lawsuit to recover debt.” This is only for private loans. Federal loans do not have an SOL.

When does the statute of limitations start?

This is going to depend on your state laws and how your contract is written. For most states it’s the first day of your default. 120 days after your last payment.

- The last payment you made. Let’s say you live in a state with a six-year statute of limitations and last made a payment in January 2019. Your creditor would have until January 2025 to sue you over the past-due debt.

- The first payment you missed. Based on the example above, the statute would now last until February 2025, since February 2019 would have been your first missed payment.

- When your loans defaulted. Default timelines vary for private loans. The Consumer Financial Protection Bureau says the average length is 120 days, but loans can also enter default after a single missed payment. – Nerd Wallet

Can you restart the statute of limitations on student loans?

Yes! Making any payment towards the defaulted debt will restart the clock. Acknowledging the debt in any way may restart the clock.

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using practices that trick you into restarting the statute of limitations. If you feel that this has taken place, contact a lawyer and submit a formal complaint to the Federal Trade Commission.

How long is the Statute of Limitations?

Typically, your loans are subject to the statute of limitations for the state you live in. But if you’re sued, the court may use a different statute based on where the lawsuit was filed or language in your loan’s paperwork. – Nerd Wallet

Check here for a list of how private loans differ from state to state: Credible – List by state

Will defaulting AFFECT my credit?

Yes, your credit score will drop substantially as will the credit score of any cosigner. However, with careful planning it can be repaired in a few years. After 7 years the account will fall off your credit and that of your cosigner. It doesn’t mean you no longer have that debt, but the servicer cannot successfully sue you and it will no longer affect your credit.

*** It is CRITICAL to note that intentionally defaulting on any of your student loans (sometimes called Strategic Default) is risky and does not come without the potential for serious legal ramifications. The government can garnish wages and take money from you even without a court judgement or order; private lenders can also sue you.***

What happens after the statute of limitations passes?

If a creditor does not know the statute has expired, it can still take you to court — never ignore a summons about your debt because a judgement can still be issued against you if you do not show up in court. You can present a defense that your student loans should be considered “time-barred,” or no longer collectible, based on the statute of limitations.

Even if the court agrees with you, your creditor may still be able to contact you about the debt, depending on your state’s laws. But it wouldn’t have access to collection tactics a court judgment could have enabled, like garnishing your wages or placing a lien on property you own.

Student Loan Bill Of Rights

Since 2014, over a dozen states—California, Colorado, Connecticut, District of Columbia, Illinois, Maryland, Maine, Massachusetts, New Jersey, New York, Rhode Island, Virginia, and Washington—have passed legislation to establish a Student Loan Borrower Bill of Rights. At least another dozen additional states are on track to pass similar legislation.

A Student Loan Borrower Bill of Rights offers critical protections seen in near every other consumer finance market.

Please look up your states initiatives and get involved. The more states that protect borrowers the easier it will be to set a federal president. Vote at a state and local level for folks who have your back.

Legal Aid & Advocacy

-

Find an Attorney – NACA

-

The Debt Collective

-

Predatory Student Lending

-

TICAS – The Institute for College Access & Success

-

Student Borrower Protection Center

-

HERA – Housing and Economic Rights Advocates

-

National Consumer Law Center’s Student Loan Borrower Assistance Project

-

Higher Ed, Not Debt

-

Student Debt Crisis Center (SDCC)

-

CFPB – The Consumer Financial Protection Bureau

-

Brookings Institution

-

Californiaborrowers.org

-

Center for American Progress

-

The Century Foundation

-

Democracy Forward

-

Consumer Finance Monitor

-

FAIL STATE – THE MOVIE

-

How to Spot Student Loan Repayment Scams