Document Catalog

THE INVESTIGATION

Over the last decade, the Brooks Borrowers team has been working on an investigative report to uncover the unjust business dealings of CEC/Brooks and the impact it has had and still has on its borrowers.

In 2024 we published our findings through The Debt Collective’s Borrower Offense Initiative.

EXECUTIVE SUMMARY

This white paper documents predatory lending and the defrauding of thousands of students who attended Brooks Institute of Photography, in Santa Barbara, California, between 1999 and 2016. It combines extensive data and testimony from nearly 500 former students at Brooks, dozens of lawsuits against Brooks and its parent company, Career Education Corporation (CEC), and media investigations of both Brooks and CEC.

As students and former employees report, recruiters routinely relied on deception to enroll students and persuade them to take out both federal and private loans. The practices alleged and documented here included the following:

- Lying about graduation rates, job placement rates, and potential salaries on graduation

- Lying about available grants, scholarships, and financial aid

- Enrolling students regardless of their qualifications and ability

- Failing to properly inform students about loan options available and the differences between federal and private student loans

- Misleading students about the actual costs of education at Brooks

- Misleading students about accreditation and the transferability of credits

After graduation, many Brooks students found it completely impossible to afford student loan payments on their actual salaries. In our sample, average debt was over $143,000 and some had balances in the hundreds of thousands of dollars.

They describe here the catastrophic effects that their debt has had, not only on their own lives but also on their loved ones, including co-signers, parents, spouses, and children. Many lives have been simply ruined by the predatory lending at Brooks.

Brooks borrowers have sought various remedies, including through individual and class-action lawsuits against Sallie Mae, Brooks, and CEC, but these have brought very limited and inconsistent relief. The Department of Education’s Borrowers Defense to Repayment program has not worked thus far.

We hold the Department of Education accountable for its negligence, for enabling the for-profit education industry as a whole and CEC in particular. It has been too often corrupted and even staffed by industry insiders. We demand a swift and meaningful remedy for the harms that we continue to suffer as a result of the fraud and predatory lending clearly documented here.

We are asking for the Department to do the right thing by providing a group-wide discharge that cancels all of the outstanding federal student loans for every single student who attended Brooks Institute and refunds for payments made on these fraudulent debts, removal of all loans from credit reporting and return of Pell and GI benefits by the end of 2024.

All our collected evidence is organized by type and by year.

YOU NEED TO DOWNLOAD WHAT YOU WANT TO USE. PLEASE DO NOT JUST COPY THE LINK. IT WILL NOT BE ACCEPTED AS EVIDENCE.

Visit our EVIDENCE GOOGLE DRIVE

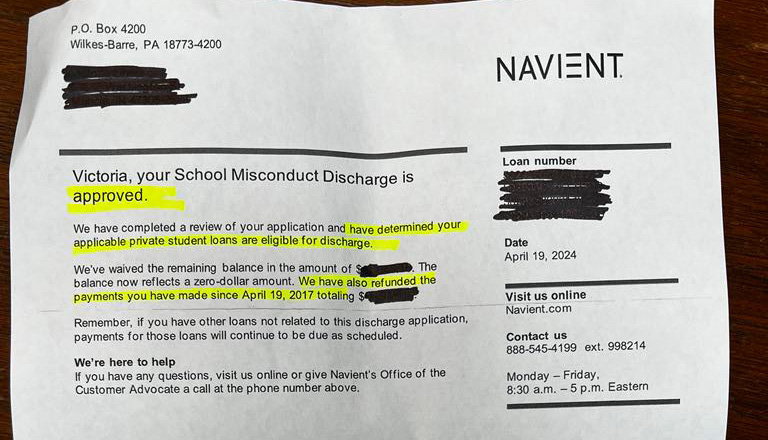

Private Loan – School Misconduct

Early 2024 several Brooks Borrowers who had filed Consumer Financial Protection Bureau (CFPB) against Navient/Sallie Mae have received a ‘School Misconduct’ application. As of June 2024, we know four Brookies that have been approved.

While this is developing information you will always find the latest information and FAQ on PPSL.org website or the Private Loan BDTR FaceBook Group.

Basic Steps for School Misconduct:

- File a complaint with the CFPB and specifically state you feel you were misled by Brooks Institute into taking this debt and you would like a ‘School Misconduct’ application.

- You should receive an answer within 30 days.

- Fill out the application using the same EVIDENCE as you would for Borrower Defense to repayment.

- Please let us know if you get approved or denied info (at) brooksborrowers.org

BIP COURSE CATALOGS, ADDMISSIONS & MARKETING

Please visit our google drive to download course catalogs, graduation & job fact sheets, admission forms and applications, etc, uploaded by other Brookies. You may need to sort by ‘name’ in the upper right to put them in chronological order.

If you have documents you would like us to add, please use this UPLOAD DOCUMENTS FORM.

BROOKS CONTROVERSY & LAWSUITS

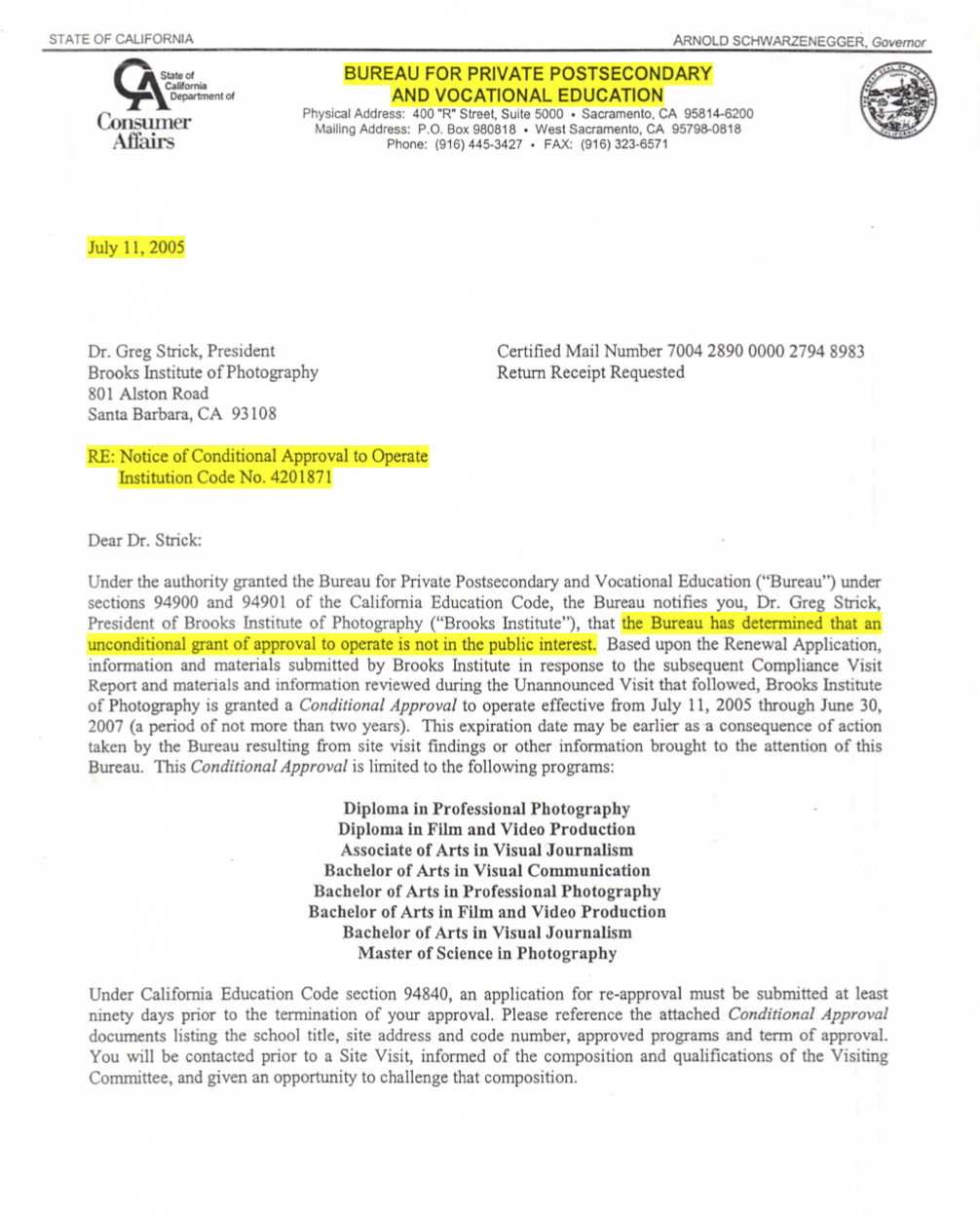

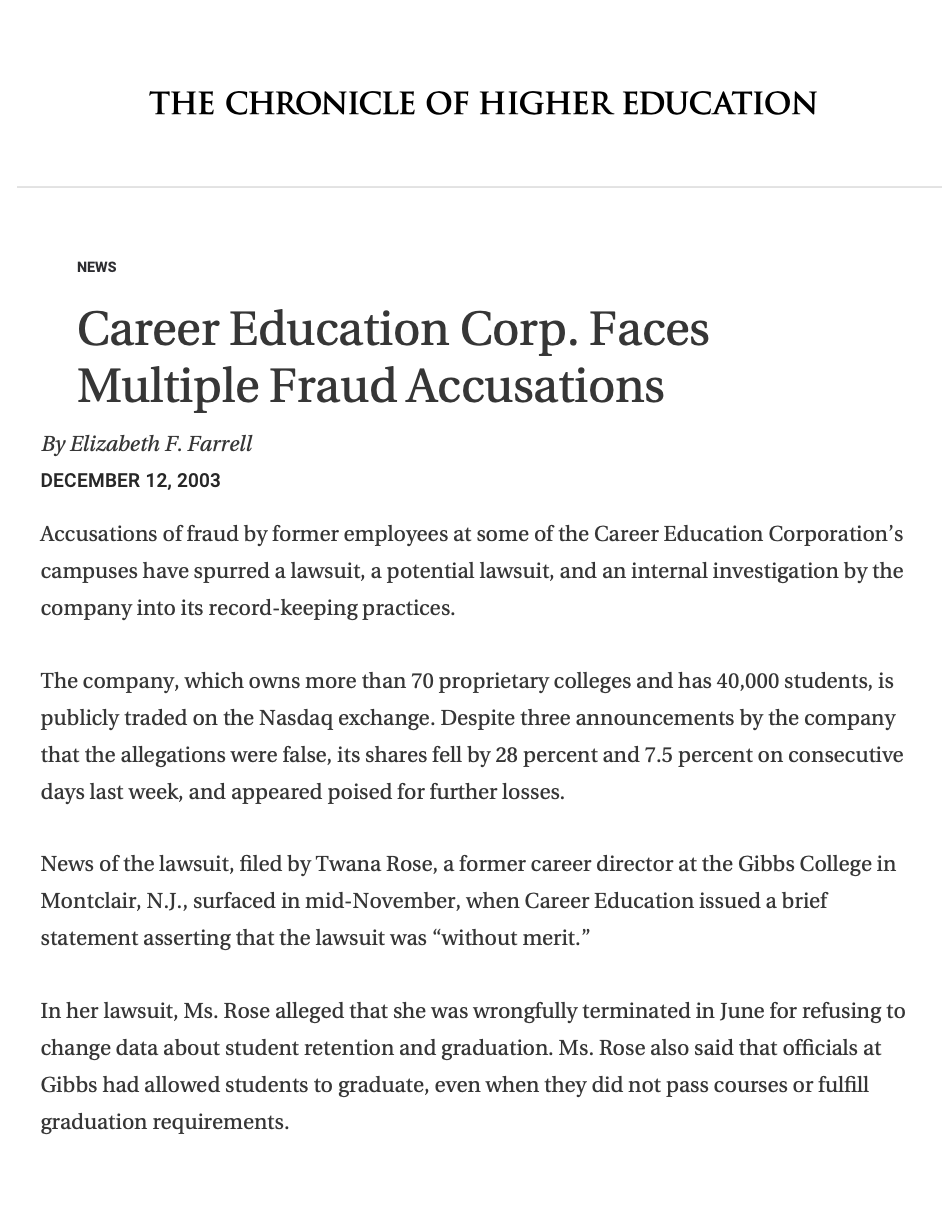

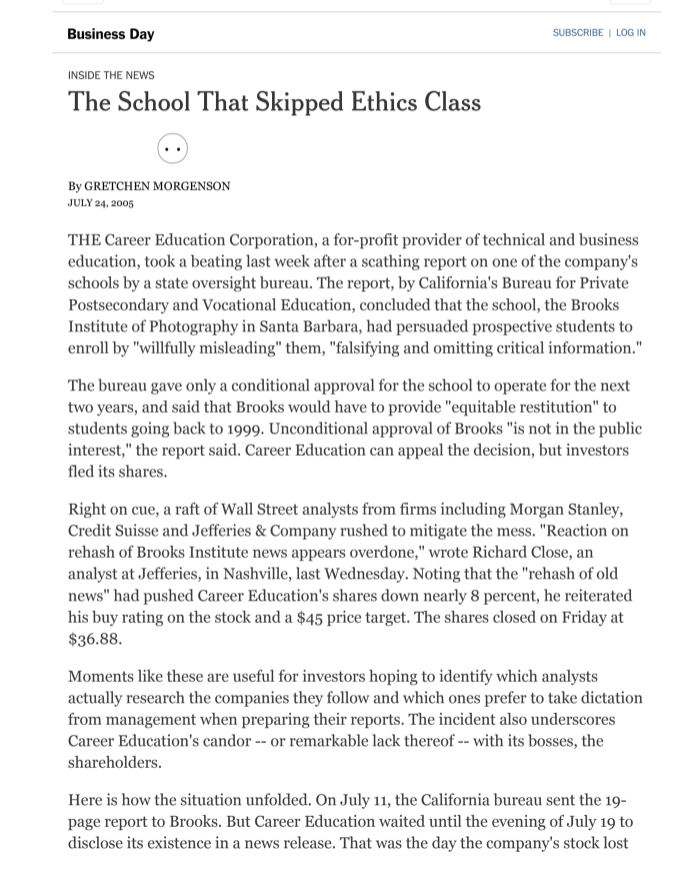

BPPE ATTEMPTS TO SHUT BROOKS DOWN

In 2005 the state of California BPPE: Bureau for Private and Post-Secondary Education – Sent a Notice of Conditional Approval to to Greg Strick, president of BIP, after an undercover investigation shows they were willfully misleading perspective students on job and graducation rates.

“the Bureau has determined that an unconditional grant of approval to operate is not in the public interest. Based upon the Renewal Application, information and materials submitted by Brooks Institute in response to the subsequent Compliance Visit Report and materials and information reviewed during the Unannounced Visit that followed”

CLASS ACTION LAWSUIT AGAINST BROOKS

In late 2007, BIP Borrowers were notified of a class action lawsuit that had started in 2005 regarding stating false graduation rates and job statistics along with aggressive recruiting practices.

This class action, argued by The Braun Law Group, also included two other CEC owned schools, Brooks College and Los Angeles Campus of American Intercontinental University. For those aware it was happening, the lawsuit was a sliver of hope for potential relief. For those who weren’t aware it was a divisive limitation to their future possibilities. On the small card sent by an obscure law firm there was an area to opt out of the class action suit, however, many students did not understand they needed to respond and even more thought it junk mail or an unwanted solicitation. Very few students opted-out. The language in the class action lawsuit stated that anyone who attended Brooks Institute between 1999 and 2007 and did not physically opt-out were considered part of the lawsuit and could not enter or start another lawsuit against CEC. The settlement wasn’t issued until 2009.

Most class members ended up only receiving, if anything, a month or two worth of loan payments.

CEC Annual Reports, Stock Reporting, Lawsuits & Transcripts

CECO – Q2 2006 Career Education Earnings Conference Call

Event Date/Time: August 3, 2006 / 5:00PM ET

In early 2006, the Securities and Exchange Commission closed its investigation into allegations that CEC had inflated attendance figures. This news was welcomed as shares fell from its peak of $70 to $31 over a two year period. However, the feeling didn’t last when the first quarter earnings showed a decrease in enrollment, and the annual forecast wasn’t positive. The shares dropped another 14% and shareholders were clearly upset over their losses, even after a wall street analysis claimed CEC had cleaned up its act, further showing they were not operating with their customers nor in the students best interest.

NYT provided a chart showing the number of recruiters that were hired compared to Career Services advisors at CEC education institutions. Using sales, increased enrollment, and loans issued to students as their recipe for success, CEC showed it was driven by shareholder interests and corporate tax-funded profits, instead of by students education.

Bostic spent $2 million for his unsuccessful campaign to replace CEC Board Members. In response, CEC spent more than double the amount in shareholders money defending its practices. Expensive infighting was one of many ways CEC used their Title IV funded profits to cover-up their illegal business approaches.

During the August 3, 2006 – CECO – Q2 2006 Career Education Earnings Conference Call, John Larson began by first addressing the stocks decline in value and how CEC planned to address the issue, “by hiring more admission representatives and providing bigger sales bonuses”.

Pat Pesch, the company’s CFO, in this same call, discussed loan approval being down and CEC finding creative ways to get around the new DoED co-signing standards. Their plan was to also reduce capital spending – corresponding with testimony highlighting Brooks’ neglect of campus upkeep, failure to update or provide equipment, and “firing” instructors, support and administrative staff in the years following. During the Q&A, Pesch discussed closing of as many as 20 underperforming campuses to boost gains.

“The approval rate for non-recourse alternative loans during the second quarter was approximately 8% lower than previous levels, primarily due to changes in co-signer requirements that were imposed on non-recourse alternative loans. We have relaxed the changes in our co-signer requirement, and are working diligently to bring alternative loan approval rates back to historical levels. As we indicated last quarter, with respect to culinary students, we are also diligently assessing other changes—other changes in the extension of credit that will responsibly balance student needs, growth opportunities, cash generation, and profitability”. [Pat Pesch – CFO of CEC 1999 – 2007]

CONGRESSIONAL TESTIMONY & Reports

Please use our google drive to view transcripts and congressional reports regarding CEC and or Brooks.

MAXINE WATERS CONGRESSIONAL TESTIMONY REGARDING CEC

On March 1, 2005, the House Committee on Education and The Workforce held a hearing on the Enforcement Of Federal Anti-fraud Laws In For-profit Education, regarding CEC in light of the 60 Minutes segment. Chairman John A. Boehner, Representative Maxine Waters, and other bipartisan U.S. Representatives were presented with witness statements’ regarding the fraudulent and misleading practices that CEC frequently engaged in, to profit from their students by abusing Title IV Funds.

“As Congress reauthorizes the Higher Education Act, our first priority has to be providing access and fairness for low and middle-income students and families struggling with the high price of college. This means holding “nonprofit” schools accountable for the role they’re playing in the hyperinflation of college costs. It means providing fairness for students at proprietary schools. And it means ensuring that federal anti-fraud laws to protect students are both adequate and fully enforced.”

“Career Education Corporation misrepresented graduation rates, promised inflated salaries to prospective enrollees, enrolled students who did not have the ability to complete casework, and focused heavily on boosting enrollment numbers and Federal student aid payments. These actions represent a disservice to students, taxpayers, and those colleges that play by the rules and provide a quality education on a fair basis.” John Boehner said March 2005 to a US House of Representatives hearing on abuse in the student aid program and the proposed changes to the College Access and Opportunity Act, H.R. 609

“In a statement made to Congress by Maxine Waters, CA U.S. House of Representatives, during a testimony on the 90/10 Title IV funding congressional hearing, includes excerpts from a letter written by a CEC owned American Intercontinental University employee, “We have been raising issue with these questionable practices ever since CEC bought AIU three years ago. We saw the demographics shift to primarily low income, D average (and below) students who were ill prepared to commit to the structure, rigors and requirements of a design college. They were taking out huge federal loans to pay for their tuition, and then because they had no funds for supplies, transportation, or even food, would fail. I have a DEEP SEATED moral problem with targeting these students, getting hold of their financial aid monies, and lying to them in a variety of ways (i.e. they will be able to get a B.A. degree in two years, they will be able to get a job with JayLo designing, they will be able to get a job with Spielberg and the list goes on and on). As stated above, the majority of these students recruited are not ready for a college, especially one that will land them $60,000 to $80,000 in debt IF they finish, which the majority does not. They have no discipline to come to class, to do the work required for completion of the course and we flunk a large number of these applicants. But that’s ok to the Administration. They allow them to withdraw or take a leave, they collect their financial aid and let them back in after a quarter off. A student who had flunked EIGHT QUARTERS (that is 3 classes each quarter at a minimum of $1800 per class for a total of $43,200.). He was re-admitted last year only to continue his poor academic standards, flunking or withdrawing from his classes!!!!!! This is not unusual.’ The faculty hold these students to standards that are in keeping with college level classes, even though we are repeatedly pressured by the administration to “work with them” meaning, “pass” them through so they do not drop out and we can no longer get their federal money!”

WAYBACK MACHINE LINKS

Mostly Brooks website screenshots – Coming soon. Links on Google Drive